Trump Misleads on Funding Sources for Global Conflicts

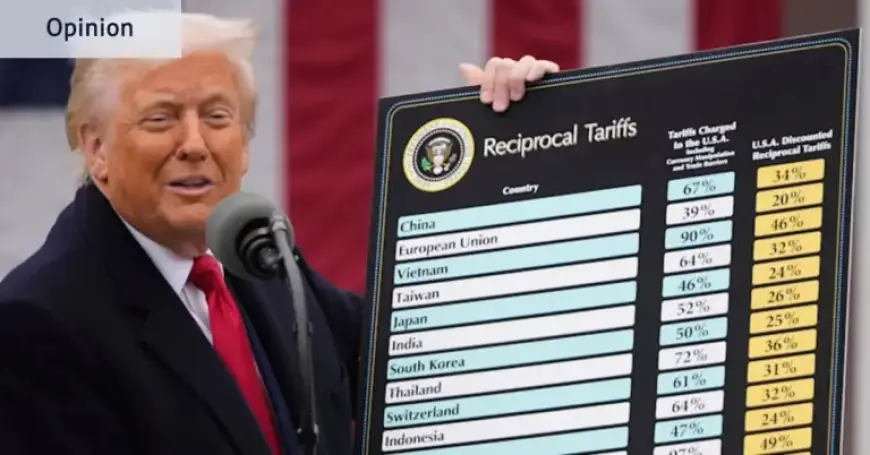

Recent discussions within the Trump administration have focused on potential modifications to tariffs imposed on steel and aluminum imports. Initially set at 25%, these tariffs increased to 50% shortly after Trump resumed office in 2025. As midterm elections approach, there are rising concerns about their effect on consumer prices.

Understanding Tariffs on Steel and Aluminum

The tariffs not only impact raw materials but also extend to various consumer goods containing foreign metal. This includes washing machines, ovens, bicycles, and even food cans. Businesses are increasingly voicing their frustrations regarding the complexity in calculating these tariffs.

Government Concerns Over Consumer Prices

US Treasury Secretary Scott Bessent confirmed that the administration is evaluating a “clarification” of these tariffs. This suggests heightened sensitivity toward the affordability of imported goods, particularly as the economic environment shifts leading into elections.

Economic Impact and Studies

Two significant studies have emerged, both contradicting claims that exporters bear the burden of the tariffs. The Kiel Institute analyzed over 25 million shipment records, revealing that foreign exporters absorbed merely 4% of the tariff costs. The bulk of the financial impact falls on US consumers and businesses.

- US importers experienced a tariff incidence of 94% in the first eight months of 2025.

- This figure decreased to 86% in the latter months, indicating possible price renegotiations with suppliers.

- Average tariff rates escalated from 2.6% to 13% by year-end 2025.

Additionally, a study from the New York Federal Reserve showed that despite exemptions and adjustments made by the Trump administration, the average import price increases significantly exceeded those of non-tariffed goods.

Consequences of Tariffs on Inflation and Employment

The Congressional Budget Office (CBO) has pointed out that the fluctuating tariffs are likely to elevate inflation temporarily and diminish real investment. They predict a reduction in GDP and overall employment levels as a direct outcome of increased costs of imported goods.

- 30% of import price increases will be absorbed by businesses.

- 70% will be passed on to consumers through higher prices.

The tariffs could lead to a doubling of consumer prices, with a substantial portion ultimately borne by US consumers. This is particularly concerning given the contradictory data on inflation rates, which remain below expectations.

Future Economic Implications

Despite current modest inflation rates, economists believe that the tariffs have a measurable impact. The US dollar’s depreciation against major currencies has also complicated the situation, potentially offsetting some of the tariffs’ intended effects.

As discussions evolve, the potential changes to tariffs will continue to influence the U.S. economy and consumer prices amid a complex interplay of domestic and international market forces. The ongoing evaluation of tariff policies by the Trump administration remains crucial to understanding their broader economic consequences.