Bavarian Nordic Posts Strong Travel Vaccine Growth, Flags Normalization in Public Preparedness for 2026

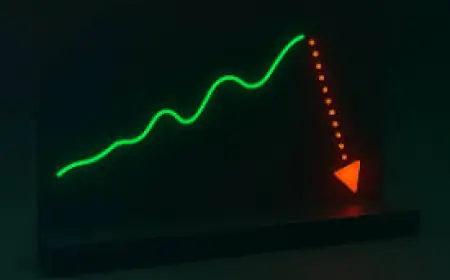

Feb. 12, 2026 (ET) — Bavarian Nordic released preliminary, unaudited results for 2025 showing a better-than-expected year driven by its Travel Health arm and a surge in demand for mpox vaccines in Public Preparedness. The company also issued guidance for 2026 that reflects a lower top line as public demand normalizes, while Travel Health is expected to continue expanding.

Travel Health drives a 30% jump in 2025 revenue

Total preliminary revenue for 2025 was DKK 6, 244 million, above the prior guidance of roughly DKK 6, 000 million. The Travel Health business delivered DKK 2, 963 million, up 30% from 2024. Core vaccines led the gain: rabies sales rose 34% and tick-borne encephalitis (TBE) grew 20%. The company’s chikungunya vaccine posted first-year sales of DKK 85 million, exceeding internal expectations by DKK 10 million.

Management highlighted this momentum as evidence that investments in commercial infrastructure and acquired assets are paying off. The Travel Health growth was broad-based and came even as global travel volumes recovered only modestly, underscoring elevated demand for specific travel vaccines rather than a simple rebound in passenger numbers.

Public Preparedness surge and overall profitability

Public Preparedness contributed DKK 3, 105 million to 2025 revenue, more than DKK 1, 000 million above what the company describes as its normal base business, reflecting continued mpox vaccine demand throughout the year. Revenue from partnered products that will be discontinued from 2026 totaled DKK 228 million.

On a profitability basis, EBITDA excluding other net operating income was DKK 1, 732 million, an EBITDA margin of 28% versus guidance near 26%. Other net operating income of DKK 810 million—driven by the sale of a Priority Review Voucher—lifted EBITDA including that item to DKK 2, 542 million and raised the margin to 41%, slightly ahead of prior expectations.

All figures are preliminary and unaudited; the audited consolidated results are scheduled for publication in the company’s annual report on March 12, 2026 (ET).

2026 guidance: lower revenue but steady Travel Health growth

For 2026, the company expects revenue in the range of DKK 5, 000–5, 200 million and an EBITDA margin of approximately 25%. Travel Health is expected to grow—management guided to roughly 10% growth from its own products and about 14% at constant exchange rates—while Public Preparedness should normalize as outbreak-driven demand eases.

Executives signaled a strategic shift toward selectively prioritizing resources. In the near term the company will slow the pace on two projects to concentrate investment where near-term commercial returns and risk-adjusted value are strongest. The finance lead has denied that a formal cost-cutting plan is being put in place, framing the move instead as targeted prioritization.

Paul Chaplin, President and CEO, said: "We are encouraged by these extraordinary results. With the commercial infrastructure in place and a proven track record of success in implementing and driving further value of acquired assets, we wish to further expand our portfolio to maximize our efforts globally. " He added that the firm remains a leading supplier of mpox and smallpox vaccines for governments, whether for outbreak response or long-term stockpiling.

Market observers will watch the March 12 audited report for confirmation of the preliminary numbers and for more detail on product-level performance and the timeline for the scaled-back projects. For now, the company’s outlook points to a Travel Health business that will continue to be the key growth engine even as preparedness sales recalibrate to a more normalized level in 2026.