Accountant John Rosenthal’s Deception: Friends Overlooked His Schemes and Missing Funds

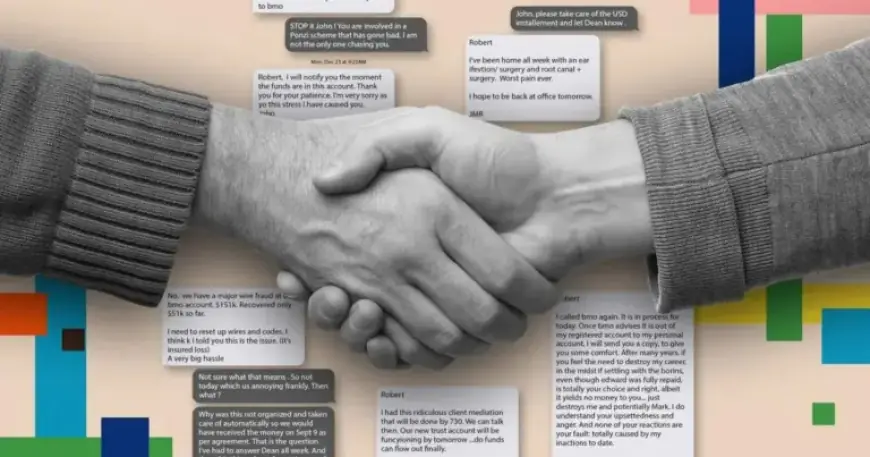

Accountant John Rosenthal, once esteemed by wealthy clients for his financial acumen, is now embroiled in a web of allegations involving deception and missing funds. Friends who placed their trust in him have found themselves facing the harsh reality of financial loss. In 2024, many investors, including prominent figures in Toronto, began to express concerns over delayed payments and missing interest cheques. They feared they had fallen victim to a scam operated by Rosenthal and his partner, Mark Zaretsky.

Investment Promises and Broken Trust

In 2024, Rosenthal solicited investments from clients promising substantial returns on real estate projects. Many of his former friends and clients provided him with hefty sums, believing the close relationship they had built over the years would ensure their investments were safe.

- Robert Sidi invested $320,000, alleging he is now out $156,000.

- Dianne Firth invested $235,000 after selling her home, trusting Rosenthal as a family friend.

- Toronto lawyer Peter Israel, who invested $300,000, expressed disappointment when his cheques began bouncing.

- Bookseller Edward Borins invested over $815,000, facing issues with documentation as early as 2018.

Signs of Trouble Emerge

In September 2024, Sidi received disturbing news from Rosenthal, claiming that a “cyber attack” and “major wire fraud” had frozen his bank accounts. As more investors experienced difficulties receiving their returns, suspicions grew. By late 2024, an increasing number of complaints prompted several lawsuits against Rosenthal and Zaretsky, with claims exceeding $13 million across 15 court actions.

Rosenthal’s reputation as a trusted accountant began to crumble. His assurances that he would resolve the issues never materialized, leading to revelations about his financial practices. Allegations suggest he may have been running a Ponzi scheme, which operates by using funds from new investors to pay earlier investors without any legitimate business activity.

Regulatory Scrutiny and Consequences

By 2023, regulatory actions against Rosenthal escalated when the Chartered Professional Accountants of Ontario received complaints about his dealings. An investigation revealed that he had mingled investor funds with personal finances, used funds inappropriately, and pressured investors to withdraw complaints regarding their investments.

In 2025, both Rosenthal and Zaretsky were stripped of their licenses. Rosenthal was fined $100,000, while Zaretsky was fined $50,000. Their firm, RZN, LLP, was deregistered, barring them from practicing accounting altogether.

Impact on Investors

The fallout has devastated many investors, some of whom lost their life savings. Gilbert Sharpe, a former bureaucrat, reported a loss of $40,000 and mentioned that while he felt disappointed, he did not harbor anger toward Rosenthal. Meanwhile, other investors have initiated contact with law enforcement, seeking justice for their losses.

- Michael Levine, who considered Rosenthal a close friend, is also financially impacted.

- Marcia Lipson, Rosenthal’s wife, is listed among creditors seeking recovery of $1.9 million.

The Future of Rosenthal and His Associates

As of late 2023, Rosenthal’s financial situation remains dire. He has reportedly declared bankruptcy, owing over $17 million, with major claims from aggrieved investors. Many are still astonished that criminal investigations have not yet been launched against him or Zaretsky.

As investigations continue, many affected individuals are left grappling with loss, betrayal, and the painful reality that trust placed in a friend and accountant led to significant financial distress.