U.S. and Taiwan strike tariff pact at 15%, unlock up to $500B in investment

The United States and Taiwan have concluded a reciprocal trade agreement that trims or removes 99% of tariff barriers and sets a 15% rate on most goods, with Taiwanese authorities also outlining up to $500 billion in investment and credit support aimed at U. S. industries. The deal was signed Thursday evening ET under the auspices of the two sides’ de facto missions.

What the agreement does

The pact standardizes most tariffs between the two economies at 15%, placing Taiwan on the same footing as several other Asia-Pacific partners. The shift is designed to streamline market access and reduce friction for manufacturers and consumers on both sides of the Pacific. The framework includes reciprocal provisions intended to ease U. S. sales of autos, pharmaceuticals, and food products in Taiwan, while giving Taiwan-based exporters a more predictable rate into the American market.

Alongside the tariff measures, Taiwan signaled plans to channel substantial capital into the United States. The package includes $250 billion in direct investments across semiconductors, artificial intelligence applications, and energy, supported by up to an additional $250 billion in credit guarantees aimed at helping small and midsize firms expand operations in the U. S.

Chips at the core—and a bid to rebalance trade

Semiconductors sit at the center of the deal. Taiwan is a pivotal node in the global chip supply chain, and U. S. reliance on imported components from the island has contributed to a sizable bilateral trade gap that approached $127 billion during the first 11 months of 2025. The new commitments encourage Taiwan-based companies to expand fabrication and advanced packaging capacity inside the United States, with the goal of easing that imbalance, bolstering supply resilience, and accelerating deployment of cutting-edge manufacturing.

U. S. authorities frame the arrangement as a way to seed multiple world-class industrial parks focused on advanced technologies, with complementary incentives and infrastructure support to speed construction timelines. In a notable shift from earlier proposals that floated tariffs as high as 32%, the final 15% rate reflects the broader investment package and the promise of stateside production.

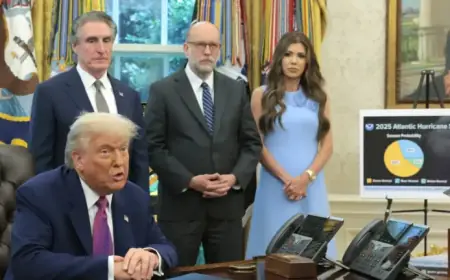

Who signed—and what comes next

The agreement was signed under the guidance of the American Institute in Taiwan and the Taipei Economic and Cultural Representative Office in the United States. The U. S. side was represented by the trade and commerce chiefs, while Taiwan’s delegation included Vice Premier Li-chiun Cheng and Minister Jen-ni Yang. In Taipei, President Lai Ching-te said Taiwan agreed to reduce tariffs on imports from the United States while keeping the rate unchanged on 93 sensitive items to protect key agricultural and industrial sectors, including rice.

Next steps include parliamentary review in Taipei and U. S. administrative processes to phase in the new tariff schedule and investment support measures. Implementation will likely roll out in stages, with customs guidance and sector-specific rules to follow.

Geopolitical stakes and regional context

The pact lands as Washington and Taipei deepen economic ties ahead of high-level travel to Beijing planned for April. Taiwan is self-governed and faces ongoing pressure from Beijing, which opposes formal state-to-state engagement with the island. While the new arrangement was executed through longstanding unofficial channels, its scope underscores a strategic push to harden supply chains in critical technologies and to align with like-minded economies in the region.

In trade and travel shorthand, Taiwan is frequently tagged by the airport code for Taipei, TPE, which sometimes surfaces in dashboards or data fields as “tpe country. ” The label is informal but reflects the island’s outsized role in global logistics and advanced manufacturing.

Winners, holdouts, and sector impacts

Multiple industries stand to gain from tariff clarity at 15%. U. S. automakers and pharmaceutical firms anticipate smoother entry into Taiwan’s market, while food exporters could see improved margins if non-tariff frictions also ease. On the Taiwan side, electronics, machinery, and chemical producers benefit from a unified rate and greater certainty for long-term contracts. Carve-outs remain: 93 product categories will keep current protections in Taiwan to shield vulnerable producers, particularly in agriculture.

For consumers and downstream manufacturers, the combination of stable tariffs and onshore chip capacity could moderate price volatility in electronics and vehicles over time. The ultimate pass-through will depend on currency moves, logistics costs, and the speed at which new U. S. fabrication and packaging facilities come online.

What to watch next

- Legislative approval in Taipei and subsequent rulemaking on both sides.

- Site announcements and groundbreaking timelines for U. S. -based chip and AI facilities tied to the investment package.

- Customs guidance detailing phase-in dates for the 15% tariff line and the list of excluded items.

- Supply chain indicators—equipment orders, construction spending, and hiring—signaling how quickly capacity will scale.

- Any adjustments connected to broader regional diplomacy as April approaches.

If executed on schedule, the deal could mark a durable shift in U. S. –Taiwan trade architecture, pairing tariff clarity with capital deployment to reshape advanced manufacturing footprints over the next several years.