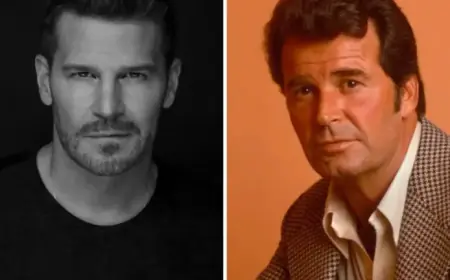

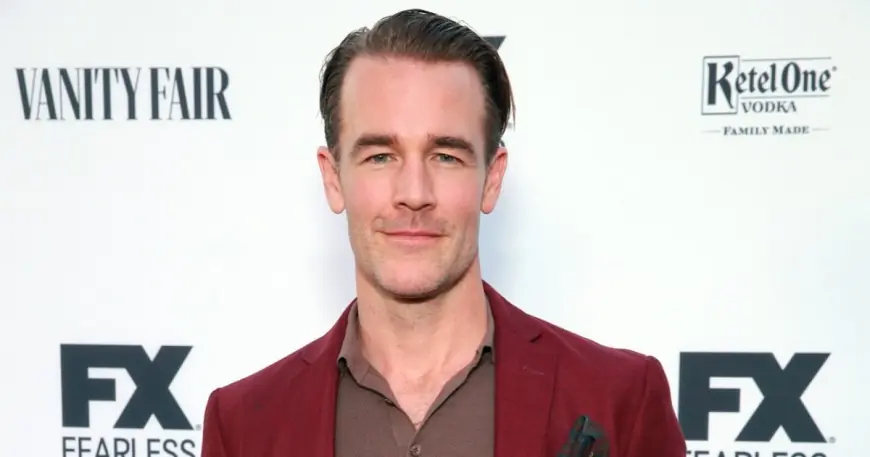

James Van Der Beek Net Worth: Why Estimates Cluster Around a Few Million, and Why the Number Isn’t the Full Story

Searches for James Van Der Beek net worth surged this week after news of his death on Wednesday, February 11, 2026 ET, prompting a familiar question: how much wealth did the longtime TV and film actor leave behind? The most widely circulated estimates place his net worth in the low single-digit millions, but the more important takeaway is why celebrity net worth figures can vary sharply — and how medical costs, taxes, real estate debt, and income timing can reshape what a “net worth” headline actually means for a surviving family.

What’s the Best Current Estimate of James Van Der Beek Net Worth?

Across the most commonly repeated industry estimates, James Van Der Beek’s net worth at the time of his death is generally placed at roughly $3 million. Some write-ups float higher headline numbers by folding in gross property values or assuming minimal liabilities, while others print dramatically lower figures that appear inconsistent with his decades-long career unless substantial debts and expenses are assumed.

A reasonable, cautious way to frame it is this: the prevailing public estimate is in the low millions, with meaningful uncertainty because the public does not have access to his full balance sheet.

Behind the Headline: How a Working Actor’s Money Actually Works

Van Der Beek’s career fits a pattern that often confuses the public: a breakout role creates fame, but not always a simple, compounding fortune. For actors best known for a hit series, the long-run wealth equation is typically driven by four variables:

-

Residual structure and renegotiations

Residual payments can be meaningful, but they depend on contract terms, distribution changes over time, and how content is licensed. -

Consistency of work after the signature role

Steady roles, guest arcs, voice work, and producing can add up, but the income is lumpy — large checks can be followed by long gaps. -

Real estate choices and leverage

Buying property can increase net worth on paper, but mortgages, renovations, property taxes, and insurance can turn a “valuable home” into a cash-flow drain. -

Health, time away from work, and major out-of-pocket costs

When serious illness enters the picture, it can reduce earning power and increase expenses at the same time, a double squeeze that celebrity headlines often gloss over.

Stakeholders and Incentives: Why Different Sources Publish Different Numbers

There are incentives on all sides that push net worth figures up or down:

-

Entertainment-content publishers benefit from a clean, shareable number, even if it compresses nuance.

-

Real estate angles tend to emphasize property value, which inflates the impression of liquid wealth.

-

Human-interest fundraising coverage can highlight financial strain, emphasizing bills, uncertainty, and ongoing costs that aren’t captured by a simple asset estimate.

None of that automatically means any single figure is “wrong.” It means the estimate is often a simplified proxy for a complicated reality.

What We Still Don’t Know

Several missing pieces determine whether a low-millions headline translates into long-term security for survivors:

-

How much of the reported wealth was tied up in home equity versus liquid savings

-

The scale of medical expenses, insurance coverage, and any remaining obligations

-

Tax exposure, including the timing of income and deductions in the final years

-

Whether there were business interests, investment accounts, or trusts not visible publicly

-

Estate planning details and how assets are structured for a spouse and children

Until probate filings, tax records, or family statements clarify these items, any “exact” number should be treated as an estimate rather than a settled fact.

What Happens Next: 5 Plausible Scenarios to Watch

-

Estate details modestly confirm the low-millions range

Trigger: filings show a typical mix of home equity, retirement accounts, and standard liabilities. -

Net worth lands lower than headlines due to debts and costs

Trigger: sizable medical obligations, loans, or concentrated real estate leverage. -

Net worth lands higher due to hidden assets or insurance payouts

Trigger: life insurance, private investments, or deferred compensation becomes visible. -

Short-term cash pressure persists even with meaningful assets

Trigger: assets are illiquid, while expenses for a large household remain immediate. -

Posthumous projects increase earnings

Trigger: previously completed work releases, generating payments that arrive after death.

Why It Matters

The Van Der Beek net worth question is ultimately a lesson in how celebrity finances are often misread. Fame is not the same as liquidity, and a headline number is not the same as stability — especially for a household with significant ongoing costs. The practical impact over the next year will hinge less on a single estimate and more on what portion of the estate is accessible cash, how obligations are resolved, and whether future payments arrive on a predictable schedule.