HMRC Apologizes, Corrects Pension Errors for 800,000 Affected Britons

A significant error in the state pension payment system affecting approximately 800,000 Britons has been resolved. HM Revenue and Customs (HMRC) has acknowledged and apologized for the inaccuracies in pension forecasts, which could potentially lead to retirement savings deficits.

Details of the Pension Error Correction

On February 14, 2024, HMRC addressed a flaw in its online state pension forecast tool that had persisted for nine years. This issue specifically impacted individuals who had “contracted out” of the additional state pension and who are set to reach retirement age after April 2029.

Background of the Error

The error was first reported to government ministers in 2017, yet corrective measures were not implemented until February 2024. The online forecast tool was introduced in February 2016, shortly before the launch of a new state pension system. Within three years, around 360,000 individuals had already received inaccurate estimates.

Impact on Affected Individuals

The flawed forecasts misled many into believing they qualified for the maximum state pension without needing additional contributions. Those affected include individuals who redirected their National Insurance contributions to private or workplace pensions, reducing their entitlements upon retirement.

- As a result, inaccurate predictions indicated that users had accumulated sufficient contributions for full payments.

- This oversight leaves individuals at risk of receiving smaller pensions than expected, without the option to correct the shortfall through additional contributions.

HMRC’s Response

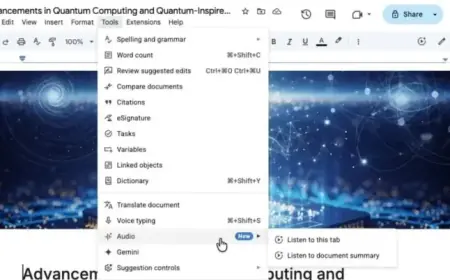

HMRC has confirmed that the updates to the forecasting tool will now accurately consider periods when individuals were contracted out of the state earnings-related pension scheme, known as Serps. An HMRC spokesperson apologized for the challenges users faced due to the error.

Steps for Affected Individuals

To qualify for the full new state pension, individuals must have 35 years of National Insurance contributions, currently equating to £230.25 each week. The HMRC has indicated that those affected can make lump sum payments of up to £907 for any missing year of contributions.

Sir Steve Webb, a former pensions minister, emphasized the importance of this correction, stating that retirees should not rely on inaccurate forecasts, which he referred to as “built on sand.” He welcomed HMRC’s commitment to enhancing the accuracy of their forecasts.