Les Wexner and Sultan Ahmed bin Sulayem Face Fresh Scrutiny as Lawmakers Name Redacted Figures in Epstein Files

A fast-moving political and corporate fallout is unfolding in Washington and abroad after lawmakers publicly identified six men whose names had been redacted in recently released Jeffrey Epstein investigative materials. The disclosures have pulled Les Wexner, longtime billionaire retail figure, and Sultan Ahmed bin Sulayem, the top executive of global ports operator DP World, into a renewed spotlight, while also surfacing lesser-known names such as Salvatore Nuara and Leonic Leonov that remain largely unexplained in public records.

At the center of the latest burst of attention is a transparency fight: whether federal authorities improperly obscured identities in Epstein-related documents, and what accountability looks like when public trust and private power collide.

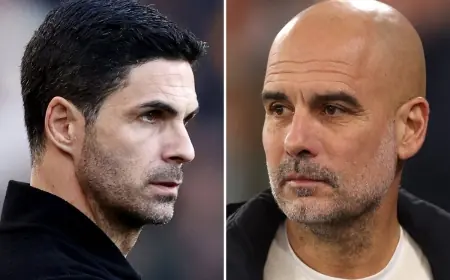

Ro Khanna and the Capitol Hill push that put Les Wexner back in the headlines

In recent days, Representative Ro Khanna and allies have argued that redactions in the Epstein document releases went beyond protecting victims and investigative methods. Khanna publicly named six men he said had been removed from view, including Les Wexner and Sultan Ahmed bin Sulayem, alongside Salvatore Nuara, Leonic Leonov, Zurab Mikeladze, and Nicola Caputo.

The naming matters less as a verdict and more as a trigger: it forces institutions to answer basic questions about why names were hidden, what the underlying documents actually show, and whether the public is being asked to accept selective transparency. Importantly, a person appearing in investigative files is not, by itself, proof of criminal wrongdoing. But once names are out, reputational and financial consequences can arrive long before legal conclusions do.

Jamie Raskin escalates pressure on the Justice Department

Representative Jamie Raskin, a senior Democrat on the House Judiciary Committee, has intensified scrutiny of how the Justice Department has handled the Epstein material, accusing the department of mismanagement and politically charged decision-making around what is released and what remains obscured.

This sets up a familiar Washington collision: lawmakers demanding maximal disclosure, prosecutors emphasizing constraints, and victims’ advocates warning that sensational releases can re-traumatize survivors or muddy accountability. The committee fight is also a proxy battle over credibility. Whoever convinces the public they are protecting justice rather than shielding the powerful gains leverage heading into the next phase of hearings and subpoenas.

Sultan Ahmed bin Sulayem and DP World: investor backlash spreads beyond politics

The ripple effects are already visible in the business world. Major institutional partners have paused or reconsidered new investment activity connected to DP World after renewed attention to bin Sulayem’s historical interactions with Epstein surfaced in the broader document trove.

For a global infrastructure operator, the immediate risk is not only leadership scrutiny but deal friction: joint ventures slow down, financing committees ask harder questions, and counterparties demand governance assurances before committing capital. Even if no criminal allegation is established, the reputational risk can translate into measurable costs through delayed projects and higher perceived counterparty risk.

What we know, what we do not: Salvatore Nuara and Leonic Leonov

Two of the names drawing the most curiosity are Salvatore Nuara and Leonic Leonov because the public record, at least so far, offers little clarity about who they are or why they were allegedly among the redactions.

That ambiguity is the story within the story. When lawmakers release names without the underlying context, the information environment fills with guesswork. The incentive for opportunists is obvious: attach a name to a narrative, capture attention, and let algorithms do the rest. Meanwhile, legitimate questions remain unanswered: Are these individuals witnesses, correspondents, intermediaries, or something else entirely? Without document-level context, the public cannot accurately weigh significance.

Behind the headline: incentives, stakeholders, and the real endgame

Context: The Epstein case has long been a stress test for elite accountability, institutional transparency, and the limits of the legal system when crimes involve complex networks and powerful people.

Incentives:

-

Lawmakers gain by looking like they are forcing sunlight onto secrecy, especially in a polarized climate where mistrust of institutions is high.

-

The Justice Department gains by protecting investigative integrity, but loses when redactions appear arbitrary or self-protective.

-

Corporate partners gain by distancing from reputational risk quickly, even if facts are still developing.

Stakeholders:

-

Survivors and their families, who often want both accountability and protection from spectacle.

-

Named individuals, who face reputational consequences regardless of legal status.

-

Global investors and infrastructure counterparties, who must price governance risk in real time.

-

Regulators and oversight bodies, whose credibility depends on consistent standards.

Second-order effects:

-

More aggressive due diligence on leadership ties for companies operating in sensitive sectors like ports, logistics, and finance.

-

A surge in misinformation, impersonation attempts, and fake “document leaks,” as attention spikes.

-

Heightened pressure for Congress to set clearer rules for redactions, privacy protection, and public release protocols.

What happens next: likely scenarios and the triggers to watch

-

Hearing-driven disclosures

If upcoming hearings produce clearer descriptions of what the redactions covered, expect a second wave of reputational and market reactions. -

Subpoena and testimony calendar heats up

Les Wexner is expected to face intensified congressional questioning in the coming week. If testimony is compelled or documents are produced, new details could shift the story from names to specifics. -

Governance responses from DP World and partners

If DP World announces internal reviews, leadership measures, or governance changes, counterparties may resume paused investment activity. If not, pauses could become longer-term distancing. -

More names, more confusion

If additional redactions are challenged and more identities are revealed without context, the information fog thickens, making it harder for credible claims to stand out. -

Legal and policy reform proposals

Expect proposals around redaction standards, survivor protections, and transparency rules, with disagreements over how to balance privacy and public accountability.

The key point for now is straightforward: this is not simply a list of names. It is a high-stakes contest over who controls the narrative, who pays the cost of uncertainty, and whether institutions can deliver transparency that is both meaningful and responsible.