Mortgage rates today hover near 6% as buyers watch yields and spring demand

Mortgage rates today are holding in the low-6% range, keeping monthly payments elevated but noticeably below last year’s levels. With the spring buying season approaching, the market is reacting to a tug-of-war between easing long-term Treasury yields and still-tight housing affordability.

As of Feb. 10, 2026, 11:00 a.m. ET, daily rate trackers show the average 30-year fixed rate around the mid-6% range, while the widely watched weekly benchmark remains just above 6%.

Mortgage rates today: a quick snapshot

Mortgage pricing changes every day and varies by lender and borrower profile, but the broad picture is stable rather than swinging sharply.

| Loan type | Typical average rate (Feb. 10, 2026) | Direction vs. last week |

|---|---|---|

| 30-year fixed | ~6.28% (approx.) | Slightly higher |

| 15-year fixed | ~5.57% (approx.) | Slightly lower |

| 5/1 ARM | ~5.49% (approx.) | Roughly flat |

| 30-year jumbo | ~6.40% (approx.) | Slightly lower |

“Approx.” reflects that daily averages move with lender pricing and don’t represent a guaranteed quote.

The weekly benchmark still near 6%

A key reference point for the broader market is the weekly 30-year fixed average published each Thursday. The most recent weekly reading (dated Feb. 5, 2026) put the 30-year fixed average at 6.11%, with the 15-year fixed at 5.50%. That weekly series is often used as a trend gauge because it smooths out day-to-day pricing noise.

The gap between daily trackers and the weekly benchmark is normal: daily averages can move quickly, while the weekly figure reflects rates offered over a multi-day window.

Why rates aren’t falling faster

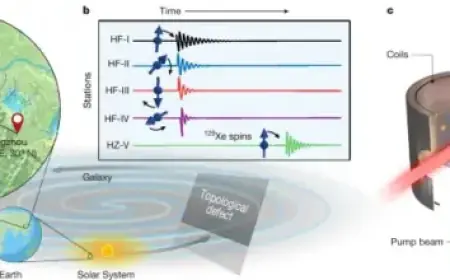

Mortgage rates tend to track long-term bond yields, especially the 10-year Treasury, but not perfectly. Lenders also price in risk, pipeline hedging costs, and demand for mortgage-backed securities.

On Feb. 10, 2026, the 10-year Treasury yield has been hovering around 4.15%–4.17%, down from recent highs. That decline would usually help mortgage rates drift lower, but spreads can widen when markets are cautious about inflation, economic surprises, or volatility in rate expectations. The result: mortgages ease slowly even when yields cool.

What it means for homebuyers and refinancers

For buyers, the difference between 6.1% and 6.3% can still matter. On a large loan balance, a few tenths of a percentage point changes the monthly payment and the amount of income needed to qualify.

For refinancers, the math remains selective. Many homeowners are still locked into much lower rates from earlier years, so refinancing often only makes sense for specific cases—such as switching loan terms, removing mortgage insurance, or tapping equity with a clear plan and manageable payment impact.

One practical implication of today’s range: lenders are competing harder on fees and credits. Even when the headline rate looks similar, the closing-cost structure can vary enough to change the “best deal.”

What to watch next

The near-term direction will likely hinge on scheduled economic releases and how they shift expectations for the Federal Reserve’s path over the next few meetings. Markets typically react most to inflation measures, employment readings, and consumer spending data—anything that changes the outlook for growth and price pressures.

If longer-term yields keep drifting lower and volatility stays contained, mortgage rates could grind down from here. If yields rebound or markets reprice inflation risk upward, rates may stay pinned near the low-6% zone into the heart of the spring season.

Sources consulted: Freddie Mac, Federal Reserve Bank of St. Louis (FRED), Reuters, Mortgage News Daily