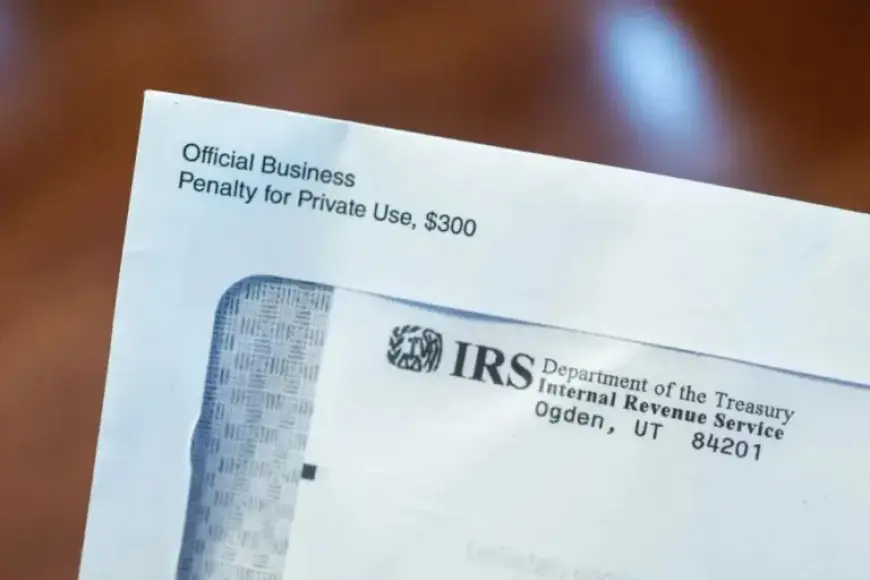

Track Your 2026 IRS Tax Refund: When to Expect It

Filing taxes can sometimes feel overwhelming, but understanding the IRS tax refund process can simplify things. As tax season approaches, it’s crucial to know when to expect your refund and how to track it effectively.

Track Your 2026 IRS Tax Refund: Key Information

The IRS will start accepting tax returns for the 2025 tax year on January 26, 2026. Each year, over 150 million individual income tax returns are filed electronically, contributing to a smooth processing experience.

Projected Refund Increases

According to experts from the Bipartisan Policy Center, refunds are expected to increase in 2026 due to newly enacted tax cuts. Don Schneider, a policy analyst at Piper Sandler, projects substantial retroactive tax relief from the legislation. This is anticipated to generate approximately $91 billion, with $60 billion allocated for refunds.

Checking Your Tax Refund Status

To track your refund, utilize the “Where’s My Refund?” tool available on the IRS website. You’ll need to provide:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your filing status

- The exact refund amount from your return

Once you enter this information, your tax return status will display one of the following:

- Return Received: Your return is being processed by the IRS.

- Refund Approved: Your refund has been approved and is being prepared for issuance.

- Refund Sent: Your refund has been dispatched to your bank or mailed to you.

Keep in mind that it may take five days for your refund to appear in your bank account or several weeks for a physical check to arrive.

Timeline for Refund Deposits

The time it takes for your refund to be processed depends significantly on how you file your return. Electronic submissions lead to faster processing, typically within three weeks. The IRS advises against relying on a specific date for receiving your refund, especially for significant expenses.

Reasons for Refund Delays

Several factors can lead to delays in receiving your tax refund:

- Errors or incomplete information on the return

- Identity theft or fraud concerns

- Discrepancies involving child tax credits or recovery rebate credits

- Claims for an Earned Income Tax Credit or Additional Child Tax Credit

- Processing times at your bank or credit union

Deadlines for Filing Taxes

Taxpayers must file their federal income tax returns for 2025 by April 15, 2026. Those residing or traveling outside the United States on this date will receive an automatic two-month extension, pushing the deadline to June 15, 2026.

It’s essential to note that for electronic filers, the submission timestamp is based on your local time zone. For paper returns, to be considered on time, they must be correctly addressed, have sufficient postage, and be postmarked by the due date.

By keeping this information in mind, you can stay informed and manage your 2026 IRS tax refund expectations effectively.