Landlords Criticize Healthscope Rescue Plan, Claim Offshore Hedge Funds Benefit

The debate surrounding Healthscope’s rescue plan has intensified, with landlords voicing their concerns. They argue that the plan primarily benefits offshore hedge funds, particularly in light of the group’s financial troubles. Richard Roos, co-head of Northwest’s Australasian operations, expressed his discontent regarding the prospective Healthscope PurposeCo entity, claiming it primarily seeks to enrich investors at the detriment of Australian taxpayers.

Concerns Over Offshores Hedge Funds

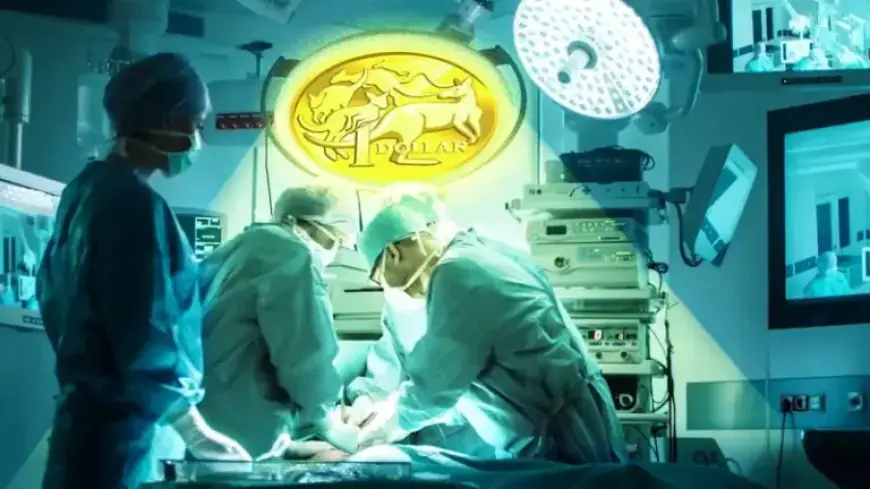

Landlords allege that the current deal favors British hedge fund Polus Capital and US-based Canyon Partners. These funds acquired a large portion of Healthscope’s $1.7 billion debt for as low as 50 cents on the dollar. Roos emphasized that if debt holders convert the company into a not-for-profit entity, it might set a troubling precedent for future financial strategies.

The Proposed Not-for-Profit Plan

The receivers from McGrathNicol, led by Keith Crawford, proposed converting Healthscope into a not-for-profit to maintain its hospital operations. Justifications for this conversion include avoiding approximately $100 million in annual payroll taxes. The plan aims to avoid significant job losses that could occur due to Healthscope’s financial instability.

- Healthscope’s landlords demand clarity on rent concessions as the receivers negotiate terms.

- Onerous rental agreements contributed to Healthscope’s financial downfall.

- Existing offers from landlords aimed at reducing rents have not moved forward yet.

Hospital Operations and Future Plans

Despite the turmoil, the private hospital sector plays a critical role in Australia. It offers about 70% of elective surgeries, relieving pressure on public healthcare.n As part of the plan to stabilize Healthscope, the receivers have sought feedback from landlords on possible rent reductions, while stating more information about the viability of the PurposeCo is needed.

Allies and Dissenters

While some stakeholders, like the Australian Medical Association’s Dr. Danielle McMullen, support the rescue plan, they highlight ongoing financial pressures on private hospitals. The landscape remains precarious, with landlords like Roos urging to prioritize sustainable healthcare rather than catering to hedge fund interests.

In conclusion, the future of Healthscope rests on navigating these financial challenges while balancing the interests of multiple stakeholders. The upcoming negotiations will be crucial to determining the viability of the proposed not-for-profit structure and the long-term health of private healthcare in Australia.