Europe’s Chemical Industry Faces Struggles Amid CLO Challenges

The European chemicals sector is facing significant challenges, raising alarms among collateralized loan obligation (CLO) managers. Recent findings from Bank of America reveal that more than 35% of floating-rate debt from chemical companies linked to CLOs was trading below 90 in January. This decline poses a serious concern, particularly as most leveraged loans are performing at or above par.

CLO Challenges in Europe’s Chemical Industry

The drop in loan prices often indicates rating downgrades and a decrease in credit quality. Within the chemicals sector, key borrowers such as INEOS Quattro Holdings, Caldic, and Archroma are rated B3 by Moody’s. This significant price drop complicates the ability of CLO managers to offload these positions without absorbing losses.

If the credit ratings of these companies decline to triple-C levels, CLO managers may find it difficult to meet their overcollateralization (OC) tests. Such a situation could result in cash being redirected from CLO equity to service notes. Should defaults occur among chemical companies, it would adversely affect CLO equity returns, amplifying the financial risks associated with these investments.

Wider Impacts on the European Industrial Landscape

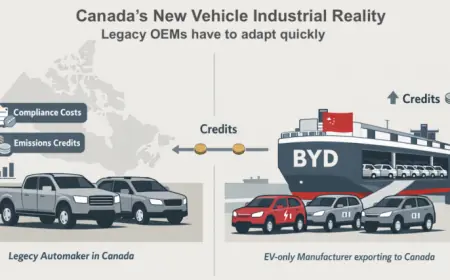

The issues within the chemicals sector are reflective of broader challenges facing the European industrial landscape. Increasingly, European chemical companies are becoming less attractive to CLOs due to uncompetitive conditions. High energy costs and pressures from inexpensive imports, particularly from China, are primary factors contributing to this trend.

A report commissioned by the EU last year indicated that several vital industrial sectors, including chemicals, automotive, and basic metals, face threats that could impact approximately 15% of the EU’s GDP. Energy prices have skyrocketed due to ongoing geopolitical tensions, especially following Russia’s invasion of Ukraine. The proportion of chemicals imported from China has jumped from 9% in 2014 to an anticipated 18% by 2024.

These conditions threaten the sustainability of European industrial companies and complicate their capital access. Given the capital-intensive nature of these sectors, companies often rely on leveraged loans from CLOs and other financing sources to support their operations and projects.

Financial Sources for Industrial Projects

- Leveraged loans

- Corporate bonds

- Project bonds

- Syndicated bank loans

Need for Strategic Industrial Policies

European governments must reassess their industrial strategies to promote investment in domestic industries. The current competitive environment has evolved, emphasizing the need for Europe to achieve greater economic self-sufficiency. Past assumptions surrounding free trade and globalization need to be re-evaluated, particularly given the shifting dynamics with major global powers.

Without strong industrial policies, Europe risks enduring economic decline and diminished geopolitical relevance. As financing becomes more difficult to secure, strategic investments in critical sectors will be essential for ensuring future stability and growth.