Australia Leads in Solar, Yet ‘Hot Spots’ Raise Energy Bills

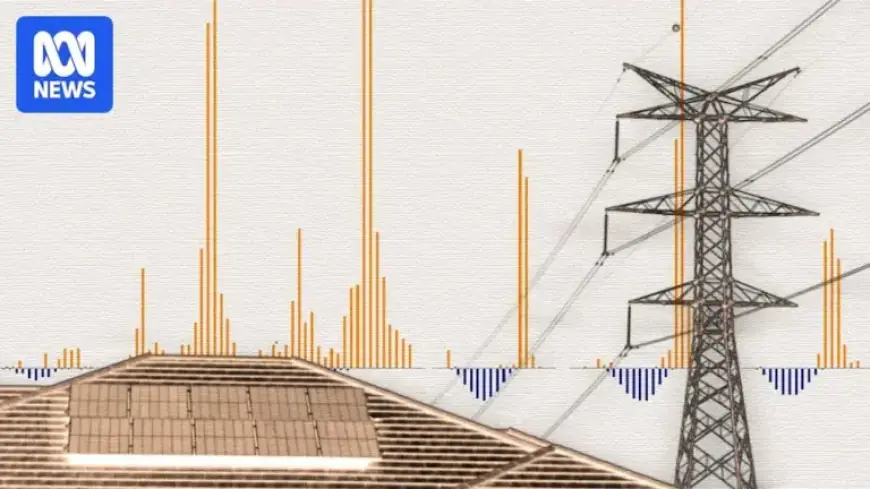

Australia is a global leader in solar energy, yet the country is facing significant challenges with electricity prices. The phenomenon of low spot power prices contradicts the high prices that consumers are currently experiencing. Analysts suggest that despite low prices during certain times, volatility in the market contributes significantly to rising costs for Australian households.

Australia’s Energy Market: High Volatility and Low Prices

Recent analyses highlight the stark contrast in Australia’s energy market, where spot prices can plunge to remarkable lows. Josh Stabler from Energy Edge notes that while electricity prices often dip, Australians feel the financial strain due to peak pricing scenarios. “You can have a lot more time holding onto the ice cube than you can the stove,” he says, illustrating the issue of price volatility.

Understanding Price Fluctuations

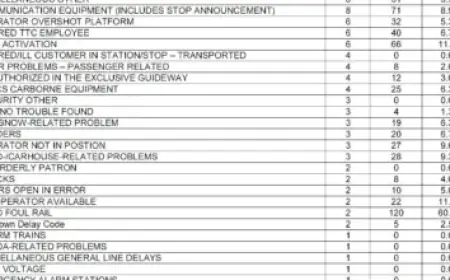

Australia’s National Electricity Market (NEM) is known for its distinctive structure. It operates as an “energy-only” market, meaning generators are paid solely for the power they produce in five-minute bidding intervals. The market rewards the lowest-cost producers but prices may also rise significantly during peak demand periods.

- Lowest prices can fall as low as -$1,000/MWh.

- Prices can soar to over $20,300/MWh in extreme cases.

This wide pricing gap is largely unique to Australia, highlighting the extreme volatility in its electricity markets. David Dixon, an analyst at Rystad, emphasizes that this volatility is unparalleled globally.

Renewables Facing Market Challenges

Despite advancements in renewable energy production, challenges persist. The Australian Energy Regulator (AER) reported that in 2024, negative prices constituted 15% of the NEM’s prices, a major increase from previous years. However, high prices, especially during evening peak hours, have a more significant impact on consumer bills.

Statistics on Price Trends

- Negative pricing increased from 3.5% in 2020 to 15% in 2024.

- Trading intervals with prices above $300/MWh rose from 0.4% in 2020 to 1.8% in 2024.

During specific quarters, the negative prices slightly influenced average costs, but high prices dominated, illustrating the challenges consumers face.

The Role of Gas and Infrastructure

High prices are exacerbated by reliance on expensive gas during evening demand peaks. As solar energy production declines after sunset, gas emerges as a necessary but costly alternative. Dixon points out that limited interconnections between states hinder the ability to share power and mitigate price increases during high demand.

Future Solutions in Energy Storage

Looking ahead, technological solutions, particularly in battery storage, promise to alleviate some of these issues. An influx of battery capacity—approximately 17 gigawatts—is projected to transform the market in the near future. Bruce Mountain from the Victoria Energy Policy Centre indicates that advances in storage technology will allow households to utilize more renewable energy and profit by selling surplus back to the grid.

However, both analysts stress that energy storage will not entirely eliminate price volatility. There will still be periods demanding alternative energy sources, such as gas or pumped hydro systems, to meet consumer needs effectively.

Conclusion

Australia leads in solar energy with promising renewable growth. Nonetheless, persistent price volatility raises concerns for consumers. As the country progresses towards a decarbonized future, addressing infrastructure weaknesses and investing in battery technology will be critical in maintaining a balanced energy market.