Key Nvidia Metric to Watch on February 25: Investors Shouldn’t Miss This

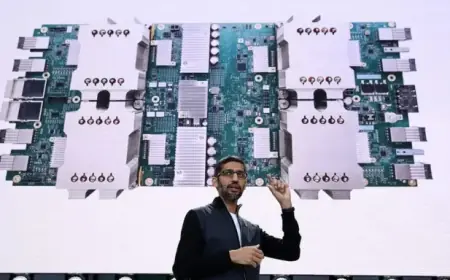

Nvidia is poised to release a vital update on February 25, an event that investors should not overlook. The forthcoming report will detail the company’s performance for the fourth quarter of its fiscal 2026, which concluded on January 25. Nvidia has seen a dramatic rise in its stock, surging elevenfold since the start of 2023, largely driven by a boom in demand for its graphics processing units (GPUs) within the AI sector.

Key Performance Indicators to Watch

The February 25 earnings announcement will culminate one of Nvidia’s most successful fiscal years, with expected total revenue around $213 billion. Impressively, the data center segment, primarily fueled by AI-related GPU sales, is projected to account for nearly 90% of this figure.

GPU Supply and Demand Dynamics

Nvidia’s GPUs are recognized for their industry-leading performance. The current generation, utilizing the Blackwell and Blackwell Ultra architectures, can achieve performance levels up to 50 times greater than the original Hopper-based chips, like the H100.

Despite this, demand for the Blackwell platform frequently surpasses supply. Attention is now shifting towards the next generation of GPUs, dubbed Rubin. Nvidia claims Rubin’s architecture will enable developers to train AI models with 75% fewer GPUs, significantly lowering inference costs by as much as 90%. Production is underway, with shipments expected in the latter half of 2023 to major customers such as Amazon, Microsoft, and Alphabet.

Customer Concentration Risks

One of the critical metrics to monitor during the upcoming report is customer concentration. Nvidia’s fiscal 2026 third-quarter figures indicated that 61% of its revenue, amounting to $57 billion, was sourced from just four major clients. This heavy reliance on a limited customer base introduces considerable risk to the company’s financial health.

- Customer A: 22% of revenue

- Customer B: 15% of revenue

- Customer C: 13% of revenue

- Customer D: 11% of revenue

This customer dependency has intensified compared to the previous year, where a single client accounted for only 12% of revenue. If one of these significant customers, potentially Microsoft, reduces its expenditure on AI data centers, it could lead to a substantial revenue drop for Nvidia.

Market Outlook and Investor Sentiment

Nvidia’s stock recently traded approximately 10% lower than its peak and presently has a price-to-earnings (P/E) ratio of 45.9. This is a marked decline from its historical average of 61.5, indicating that investors are approaching with caution. However, recent trends suggest that Nvidia often experiences positive stock performance following earnings releases, particularly when CEO Jensen Huang expresses confidence in the company’s future.

The upcoming February report could serve as a pivotal moment for investor sentiment, especially if it addresses customer concentration concerns. With the AI landscape continually evolving, many believe Nvidia’s stock could appreciate in value in the coming years.