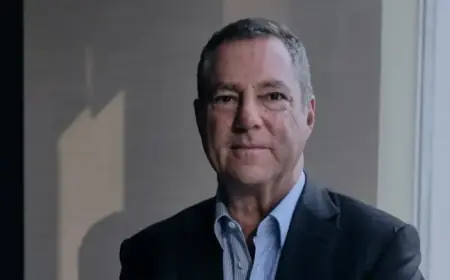

Governor Ismaili Speaks on Banking Innovation at French Business Day Conference

The Governor of the Central Bank of the Republic of Kosovo, Ahmet Ismaili, recently addressed the French Business Day conference. His panel focused on the theme of “Kosovo’s Banking and Financial Sector: A Real Opportunity for French Investors.” The event was organized by the French Embassy in Kosovo, in collaboration with the European Investors Council. It gathered key representatives from local and international institutions and featured four thematic panels.

Key Developments in Kosovo’s Banking Sector

During his presentation, Governor Ismaili highlighted significant advancements within Kosovo’s economy and reforms undertaken by the Central Bank of Kosovo (CBK). He emphasized that Kosovo’s banking sector is one of the most stable in the region. This stability is attributed to various factors:

- High levels of capitalization

- Strong liquidity

- Low non-performing loans

These attributes contribute to the support of economic activities and sustainable development throughout the country.

Commitment to Financial Innovation

Governor Ismaili reaffirmed the CBK’s dedication to enhancing the regulatory and supervisory framework. This initiative is crucial for promoting innovative financial products and services and advancing financial inclusion. The Governor stressed the importance of creating a competitive and integrated financial sector that aligns with international markets.

Furthermore, he noted that Kosovo benefits from a legal and regulatory framework aligned with European Union standards. The use of the euro as the official currency adds to legal certainty and fosters equitable competition for businesses and investors from the EU.

Strategic Focus on Digitalization

Financial innovation and digitalization were addressed as vital elements for attracting foreign investment. The Governor provided insight into plans that include diversifying funding sources beyond traditional banking. Key points discussed include:

- Advancement of guarantee schemes

- Development of the capital market

- Expansion of trade and investment opportunities

The ongoing modernization of payment infrastructures, propelled by projects like the TIPS Clone fast payments initiative, plays a critical role in enhancing efficiency. Additionally, Kosovo is progressing towards SEPA membership and pursuing open banking practices alongside regional efforts to improve financial interoperability.

Strengthening Regulatory Frameworks

Governor Ismaili highlighted the European Union’s Growth Plan and other international financial projects aimed at these objectives. The CBK is also focused on enhancing the supervision of financial service providers and improving cybersecurity standards to protect consumers. This effort is essential to ensure that the modernization of the financial system does not compromise stability.

Conclusion: A Promising Investment Destination

In conclusion, Governor Ismaili asserted that Kosovo’s financial sector successfully merges stability, modernization, and innovation within a competitive framework that aligns with European Union standards. With its robust banking system, modern financial infrastructure, burgeoning fintech potential, and favorable tax environment, Kosovo is positioned to become a key strategic investment destination. The CBK remains committed to fostering professional dialogue and cooperation aimed at creating stronger and more integrated financial systems in the region, in line with the CBK Strategic Plan.