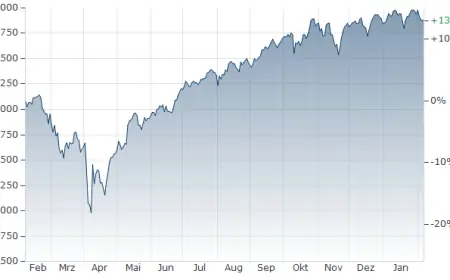

Stock market open today: U.S. trading hours and premarket movers to watch

U.S. stocks head into Friday’s session with index futures pointing higher after a sharp selloff the prior day, setting up a potentially volatile open. Traders are weighing fresh earnings reactions, big single-stock gaps, and a jump in volatility measures that suggests wider price swings could continue into the cash session.

When the stock market opens in the U.S.

For most investors, the key session is the regular trading day for the New York Stock Exchange and Nasdaq:

-

Regular session: 9:30 a.m. to 4:00 p.m. ET

-

Pre-market (extended hours): 4:00 a.m. to 9:30 a.m. ET

-

After-hours (extended hours): 4:00 p.m. to 8:00 p.m. ET

The market’s biggest liquidity surge tends to happen in two windows: the opening 15–30 minutes and the final 30 minutes into the close.

What to expect at the open

Early Friday morning, major index futures were higher by roughly half a percent, a notable swing after Thursday’s broad decline. Treasury yields were also higher, while bitcoin traded firmer, reflecting a risk-on tilt before the bell even as uncertainty remained elevated.

Two practical implications for the open:

-

Bigger gaps, looser pricing: Premarket moves can compress quickly once the opening auction prints, so early prices may not hold.

-

Earnings reactions dominate: Many of the largest movers are reacting to guidance and outlook details more than to headline earnings beats or misses.

Premarket movers: biggest gaps before 9:30 a.m. ET

Here are several of the most notable early movers, with percentage changes approx. from early premarket trading (around 7:00 a.m. ET). These can change quickly as volume builds.

| Stock | Premarket move (approx.) | What’s moving it |

|---|---|---|

| Encompass Health | +16.6% | Earnings and outlook reaction |

| Bloom Energy | +12.4% | Strong results and/or guidance response |

| Roblox | +9% | Improved forecasts and investor sentiment |

| Doximity | −30.7% | Weak forecast/guidance shock |

| Stellantis | −27.0% | Major write-down and dividend suspension |

| Molina Healthcare | −26% | Surprise loss and weaker outlook |

Other names drawing heavy attention pre-bell

Beyond the biggest gaps, several widely followed stocks are driving chatter into the open:

-

Amazon: Shares slid sharply despite upbeat spending plans for 2026, as investors focused on the quarter’s profit details and forward expectations.

-

Novo Nordisk: Shares jumped after a regulatory signal that could affect the market for lower-cost competitors to a blockbuster weight-loss drug.

-

Strategy: Shares rose alongside a stronger move in bitcoin, even after a sizable quarterly loss.

-

Coty: The stock dropped after missing earnings expectations and pulling guidance.

-

Impinj: A steep decline followed a cautious forecast, putting pressure on adjacent tech names.

If you’re watching the broader tape, pay attention to whether these moves stay isolated to single names or start pulling on sector peers (software, healthcare services, autos, semiconductors, consumer).

Key segments to watch in the first hour

The first hour often tells you whether the day is likely to trend or chop.

-

9:30–9:40 a.m. ET: Opening auction and initial price discovery. Many premarket gaps “snap” toward fair value here.

-

9:40–10:15 a.m. ET: The market chooses a direction. Watch whether advancers/decliners and volume confirm the move.

-

10:15–11:00 a.m. ET: If volatility is elevated, this window often brings the first meaningful reversal attempt.

A simple tell: if big premarket winners keep making higher highs after the first 20 minutes, buyers likely have conviction. If they fade quickly, it can signal “sell the news” behavior and broader risk aversion.

Sources consulted: New York Stock Exchange, Nasdaq, Investopedia, Barron’s