Amazon Shares Plummet: Asia-Pacific FX Market Update

The financial landscape in the Asia-Pacific region remains dynamic, particularly in light of recent developments affecting currency markets and major corporations such as Amazon. Recent earnings reports combined with central bank decisions are shaping investor sentiment across the board.

Amazon Shares Decline Following Earnings Report

Amazon reported its Q4 earnings for 2026, revealing robust operating performance yet experiencing a notable setback in its stock prices. The company posted a revenue of $124.52 billion, surpassing expectations. The standout performer was Amazon Web Services (AWS), which achieved $35.58 billion in revenue, reflecting an impressive 24% growth year-over-year before currency adjustments.

However, concerns arose due to the hefty capital expenditure outlook. Amazon projected capital expenditures around $200 billion for 2026, significantly exceeding consensus expectations of $146 billion. This revelation led to a sharp decline in stock prices, with shares dropping over 10% in after-hours trading. Investors reacted strongly to the elevated capex figures, overshadowing the otherwise positive operational metrics.

Asia-Pacific FX Market Update

The foreign exchange market in the Asia-Pacific region has been affected by several significant economic events. Importantly, the Reserve Bank of India (RBI) decided to maintain its repo rate at 5.25%. This unanimous decision came against a backdrop of low inflation and steady growth prospects. The Indian rupee remained stable following the announcement.

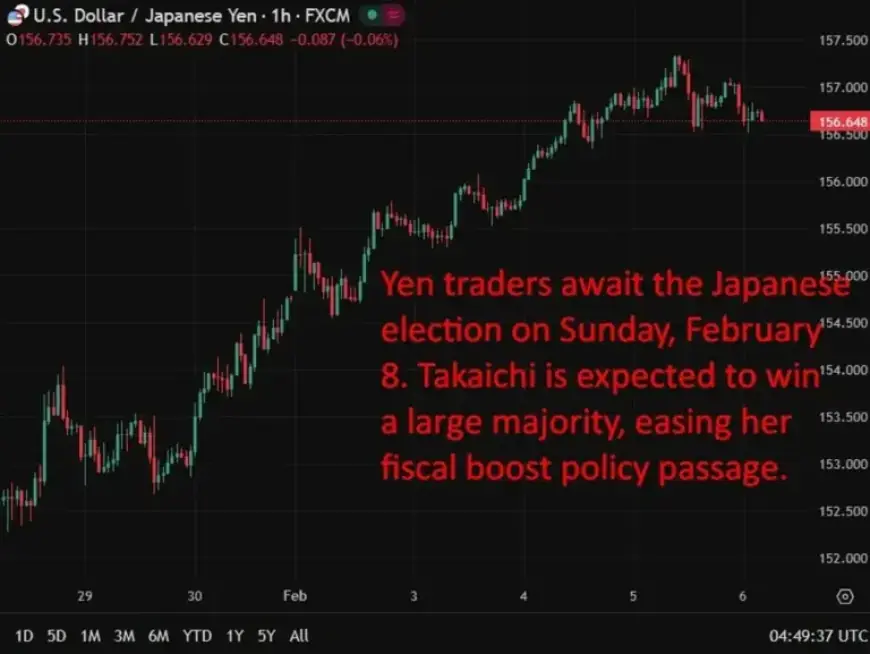

In Japan, the Bank of Japan (BoJ) is preparing for a national election on Sunday, which may impact the yen and the government bond markets. BoJ board member Masu indicated that the central bank is poised for further rate increases if economic outlooks align. Masu expressed concerns regarding yen depreciation, which can spur inflation due to rising import prices.

Key Economic Indicators

- Amazon Revenue (Q4 2026): $124.52 billion

- AWS Revenue Growth: 24% year-over-year

- Projected CapEx for Amazon (2026): $200 billion

- RBI Repo Rate: Held at 5.25%

- Japanese Yen Reference Rate: Monitoring amidst election implications

Market Reactions

The market has reacted to these developments with varying responses. U.S. equity index futures initially fell but later rebounded from earlier lows after the Amazon earnings announcement. Meanwhile, commodities markets faced challenges, as the CME raised margin requirements for gold and silver futures following recent volatility.

In summary, the financial landscape in the Asia-Pacific region continues to evolve with influential corporate earnings and central bank decisions significantly impacting market dynamics. As investors keep a close watch, the outcomes of these developments will likely shape future trends.