NT Pays Millions Daily in Interest to Remain Solvent

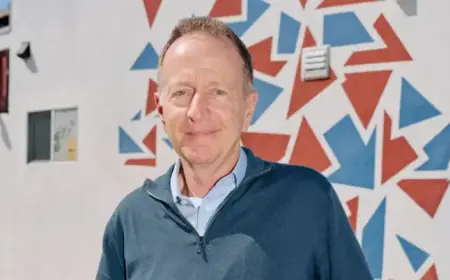

Northern Territory Treasurer Bill Yan is deeply concerned about the territory’s ballooning debt, which currently stands at $11.7 billion. This substantial financial burden keeps him up at night. He took charge of the Treasury portfolio after the Country Liberal Party (CLP) assumed power in 2024, inheriting significant debt from the previous Labor government.

Debt Forecast and Financial Strain

According to Treasury projections, the Northern Territory’s debt is expected to increase to $12.7 billion in the coming financial year and could reach $13.5 billion by 2028-29. This places the territory’s debt per capita as the highest in Australia, prompting Mr. Yan’s focus on fiscal responsibility.

- Current Debt: $11.7 billion

- Projected Debt for Next Year: $12.7 billion

- Estimated Debt by 2028-29: $13.5 billion

- Daily Interest Payments: Millions of dollars

Despite clawing back $480 million since taking office, Mr. Yan emphasized the necessity of stimulating the economy to manage and eventually reduce the territory’s debt.

Northern Marine Complex: A Path Forward

To address this financial crisis, the Northern Territory government is investing in the Northern Marine Complex at Darwin’s East Arm. This development aims to attract private investment and includes the troubled $820 million ship lift project, which has faced delays and cost overruns since its announcement in 2015.

Stuart Knowles, the Territory Coordinator, will oversee the acceleration of this vital project. Mr. Yan noted the importance of private sector involvement in the development, stating, “The private sector is going to be key to delivering that maritime infrastructure.”

Investment Trends and Economic Indicators

Recent data from the Australian Bureau of Statistics highlights a troubling $459 million decline in private investment in the Northern Territory from December 2024 to September 2025. This downturn coincided with the completion of the Santos Barossa LNG project. However, forthcoming projects like the Beetaloo phase and the Nolans Rare Earths venture are expected to significantly change the investment landscape.

Mr. Yan expressed confidence that ongoing negotiations regarding the Darwin Port buyback would provide much-needed investor certainty, with a resolution expected in the coming months.

Real Estate Market Performance

The property market in the Northern Territory is currently showing robust performance, with a reported 5.4 percent rise in housing approvals since December 2025, the highest rate among all Australian states and territories. This increase is attributed in part to successful local grants aimed at homebuyers.

- Housing Approval Growth: 5.4% since December 2025

- Grants Approved: Approximately 400

- Total Investment from Grants: $180 million

However, the increasing demand is pricing out first-time buyers, as investors flock to capitalize on high rental yields in the Darwin market.

Public Service Employment Challenges

The Northern Territory’s public service constitutes a significant portion of its budget, accounting for 43 percent of all employment. Although the CLP pledged to maintain public service roles, Mr. Yan indicated a need for efficiency improvements within the workforce.

He reassured that any rationalization of roles would focus on optimizing value and contributions from public sector positions.

In conclusion, while the Northern Territory faces daunting debt challenges, strategic investments and a focus on economic growth may pave the way for a more sustainable financial future. The coming months are crucial for the territory’s economic recovery and sustainability.