Strategy Records $6.5 Billion BTC Loss, Still Trades Above Asset Value

Strategy (MSTR), the leading publicly traded corporate holder of Bitcoin, is facing significant financial challenges. As of now, the company owns 713,502 BTC at an average acquisition price of $76,052. Presently, the market price for Bitcoin is around $67,000, resulting in an unrealized loss of approximately $6.5 billion. This loss accounts for around 12% relative to the company’s average cost.

Stock Performance and Market Reaction

The company’s stock has recently suffered, dropping about 13% in value. This decline marks the largest single-day decrease in nearly a year. Year-over-year, MSTR shares are down 66%, and they have fallen nearly 80% since reaching a record high shortly after the election victory of former President Donald Trump in November 2024.

Value Assessment and Market Premium

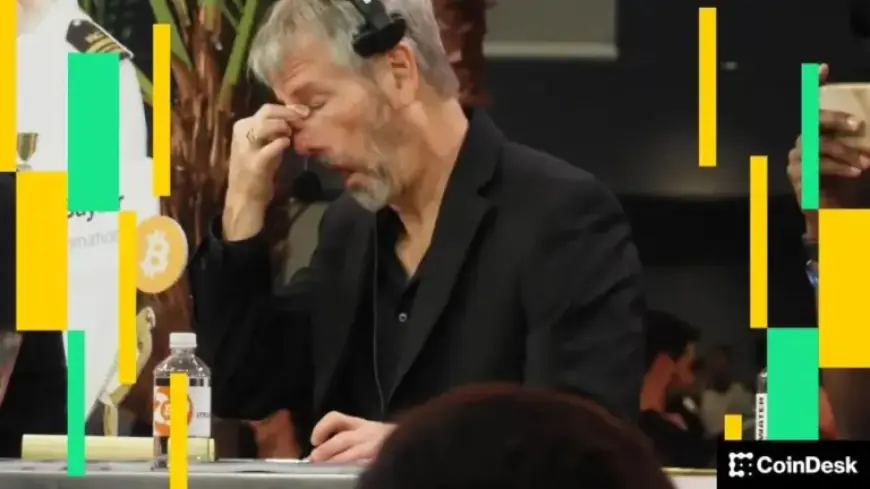

Despite these losses, Strategy is trading at a slight premium above the value of its Bitcoin holdings. Known as the multiple of net asset value (mNAV), this figure stands at approximately 1.09. This suggests that under the leadership of Michael Saylor, the company has room to issue additional common stock to purchase more Bitcoin without diluting shareholder value.

Upcoming Earnings Report

The company is set to report its fourth-quarter earnings. While no surprises are anticipated, the market is keen on hearing Saylor’s insights, particularly in light of the current market volatility.

STRC Trading and Dividend Changes

- STRC, Strategy’s perpetual preferred equity, is trading around $95, below its $100 par value.

- If it fails to recover to par by the end of the month, the dividend rate will increase by an additional 25 basis points to 11.5%.

Another comparable instrument, Strive’s (ASST) SATA, is also struggling, trading down roughly 4% at $86. This situation may similarly lead to a dividend increase.

Strive’s common equity, ASST, is currently down about 11% and trades near $0.52 per share.