Ripple’s XRP: Future Price Predictions and Market Trends

XRP has been a leading player in the cryptocurrency market as we head into 2026. The digital asset trades around $1.57, a notable decline from its January high of approximately $2.40. Investors now face uncertainty regarding whether XRP will rebound due to increasing institutional demand or face further decline as speculative interest diminishes.

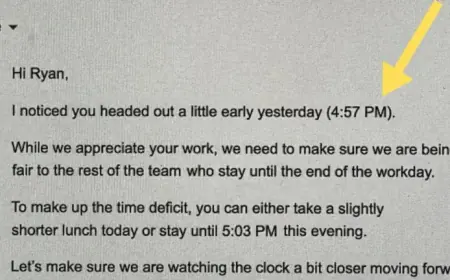

Regulatory Developments Affecting XRP

Ripple has started the year 2026 with a stronger standing in the regulatory landscape. In August 2025, the U.S. Securities and Exchange Commission (SEC) concluded its legal action against Ripple Labs, which resulted in a $125 million fine for the company. Importantly, this settlement reaffirmed a previous ruling from July 2023, clarifying that XRP is not classified as a security when traded on public exchanges.

Current Market Performance

- Current Price: $1.57

- Change: -12.54%

- Market Cap: $85 billion

- Day’s Range: $1.40 – $1.60

- 52-Week Range: $1.40 – $3.65

- Volume: 6.1 billion XRP

The regulatory clarity has bolstered investor confidence, leading to the introduction of spot XRP exchange-traded funds (ETFs) in the United States by late 2025. By mid-January 2026, these ETFs accumulated $1.37 billion in net inflows, demonstrating significant interest from institutional investors.

Challenges and Outflows

Despite the optimistic start to 2026, momentum has waned, with XRP ETFs experiencing notable fund outflows. On January 30, 2026, a single-day outflow of $93 million was recorded, reducing total inflows to about $1.17 billion. Additionally, daily transaction fees for XRP fell sharply, from 5,900 XRP in early February 2025 to just 650 XRP by mid-December 2025. This decline in fees raises concerns about the asset’s usage and economic viability.

Long-Term Viability of XRP

XRP, initially designed for cross-border payments, may encounter volatility in the near future. The long-term success of XRP will heavily depend on its practical utilization in real-world applications rather than solely on market speculation and ETF activity. Ripple is also expanding its reach by acquiring companies that enhance its digital asset infrastructure. Recent acquisitions include:

- Hidden Road (Global Prime Brokerage) for $1.25 billion

- Rail (Stablecoin Payments Platform) for $200 million

- GTreasury (Treasury Management Platform) for $1 billion

These strategic moves aim to solidify XRP’s role in transaction settlements and liquidity management, potentially opening new avenues for growth and stability.