New Rules Ban Skyrocketing Council Rate Interest Amid Debt Crisis

Victorian councils are now mandated to implement flexible payment plans for residents facing financial difficulties. This requirement comes as part of a set of new rules aimed at addressing the growing debt crisis among ratepayers. The legislation was initiated to combat the disparities in how different suburbs manage overdue rates.

Overview of New Rules on Council Rates

As of February 2026, all 79 councils in Victoria must offer various payment options, including monthly or fortnightly plans. This flexibility is essential for residents who are struggling with the rising cost of living. The state has recorded an alarming rise in unpaid council rates, now averaging 10.44 percent for the 2024-2025 financial year.

Changes to Eligibility and Interest Charges

Residents seeking relief from their rates do not need to demonstrate complete financial ruin. Instead, they must show that payments would result in significant hardship. To have their rates waived entirely, residents must prove an inability to afford essential living expenses, specifically food, medicine, and utilities.

Moreover, councils can no longer impose interest during approved deferral periods. While penalty interest in hardship cases is discouraged, it is not entirely prohibited. This shift is intended to alleviate the burden of cumulative interest charges that have contributed to deeper debt levels for vulnerable individuals.

Response to the Debt Crisis

This policy change follows a 2021 investigation by former Ombudsman Deborah Glass. The investigation revealed that many councils were quick to pursue legal action against overdue taxpayers while failing to inform them of available relief options. The new guidelines aim to rectify these practices, particularly for those adversely affected by heavy-handed collections.

Statistics on Unpaid Rates

Recent data from Payble indicates that the crisis is escalating, with an average of 11.6 percent of households in arrears for the 2025-2026 financial year. Areas such as Yarra Ranges and Whittlesea are particularly hard-hit, with nearly 20 percent of residents falling behind on their rates.

- Highest Rates of Arrears:

- Yarra Ranges: 20%

- Whittlesea: 20%

- City of Port Phillip: 18.87%

- City of Brimbank: 17.69%

- City of Frankston: 16.84%

Additionally, Stonnington experienced a dramatic 66.6 percent increase in owed rates between 2023-2024 and 2024-2025, indicating that even more affluent districts are feeling the strains of this crisis.

Service Innovations in Councils

Some councils are exploring innovative solutions to assist residents. For instance, the City of Dandenong has introduced options for automated, smaller weekly or fortnightly payments. This approach has shown positive results, reducing the arrears rate significantly.

Dandenong’s Mayor, Sophie Tan, emphasized the popularity of these installment plans. She highlighted that traditional payment options often pose a challenge for residents managing tight budgets. Tailoring payment methods to individual financial circumstances is crucial for fostering community participation.

Future Measures by the State Government

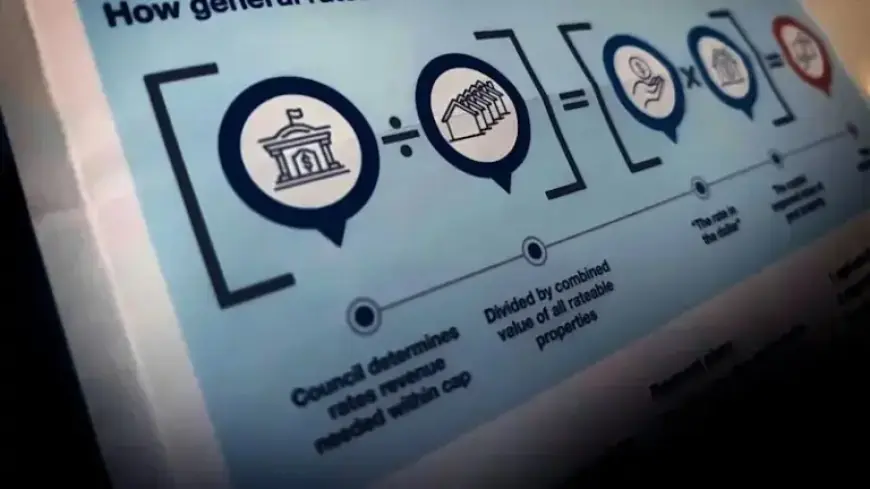

The Municipal Association of Victoria supports the new guidelines and stresses the importance of preventing crises among residents. When ratepayers are not in financial distress, they can actively engage in their communities and recover economically. In an effort to further alleviate financial pressures, the state government has capped rate increases at 2.75 percent for the 2026-2027 financial year.

This new regulatory framework marks a significant step in supporting Victorian ratepayers. By addressing issues regarding council rate interest and providing necessary flexibility, the government aims to stabilize the financial situation for many households across the state.