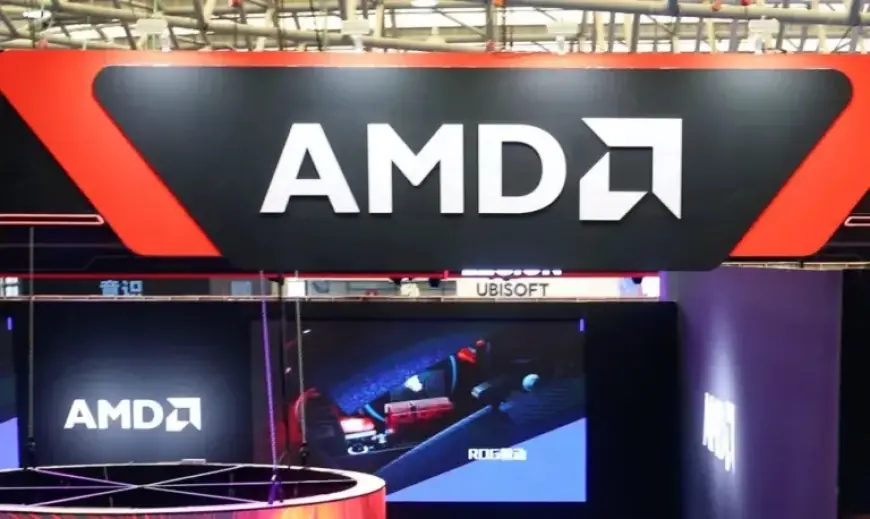

AMD Stock Dips Despite AI Revenue Boost from Unexpected China Sales

Despite a boost in artificial intelligence revenue, AMD stock has dipped due to unexpected sales declines in China. The recent trend highlights the complexity of the tech company’s financial landscape.

Key Insights on AMD’s Stock Performance

AMD’s performance in the stock market has been receiving mixed signals, primarily influenced by its sales in the Chinese market. This unexpected downturn has led to a noticeable dip in stock prices, even amid strong revenue growth from AI-related products.

Challenges Ahead

- Unexpected sales declines in China.

- Overall stock performance impacted despite AI revenue boost.

Market analysts had initially anticipated a different trend, pushing projections for AMD’s growth. However, the factors affecting sales in China have raised concerns among investors and analysts alike.

Financial Outlook

AMD’s latest financial report indicates that while AI revenue is climbing, the pressure from decreased sales in key markets could hinder overall profitability. The company’s reliance on emerging technologies must navigate these challenging market conditions.

The Importance of the Chinese Market

China represents a significant aspect of AMD’s global sales strategy. As the Chinese market continues to evolve, its impact on revenues must be closely monitored. Sales fluctuations in this region could lead to broader implications for AMD’s financial health.

Looking Forward

Despite the short-term challenges, AMD remains optimistic about its strategic direction in AI innovations. The company aims to leverage its technological advancements to regain investor confidence and stabilize stock performance.

In conclusion, while AMD’s growth in AI revenue is promising, unexpected sales declines in China pose a challenge that cannot be overlooked. Stakeholders must remain vigilant as the company navigates this turbulent landscape.