Refocus on the Cost of Living Amid Rising Interest Rates

The economic landscape of early 2026 is marked by challenges, with rising interest rates and inflation affecting households across the globe. US President Donald Trump’s ongoing disruptions have exacerbated these issues. The International Monetary Fund recently warned that economic risks are largely skewed towards the downside, prompting the Reserve Bank to raise interest rates by 0.25 percentage points.

Understanding Cost of Living Amid Rising Interest Rates

Despite these challenges, not all households are facing a severe cost-of-living crisis. Economic surveys indicate that the majority of families are managing their finances relatively well, even as interest rates increase. However, single-parent households and those with low incomes are more susceptible to financial stress.

Statistical Insights on Financial Stress

Research by Australian National University economist Ben Phillips highlights trends in financial stress. He notes that rates of daily financial strain have remained relatively stable over the years. Phillips emphasizes that current financial conditions might even be better compared to earlier periods.

The Household, Income and Labour Dynamics in Australia (HILDA) report, a significant source of data on financial well-being, shows that financial stress indicators have fluctuated. Key statistics include:

- In 2022, approximately 30% of Australians reported experiencing financial stress.

- This figure rose to 34% in 2024, still below peaks seen in 2001 and 2011.

- About 12% of respondents in 2024 could not pay utility bills on time, a lower percentage than in previous years.

Additionally, a Reserve Bank review indicated that only 0.7% of mortgage holders are at significant risk defaulting on loans, which is the lowest proportion in two years. Home borrowers seem to experience less financial stress compared to the general adult population.

Cost of Living Concerns

In early 2022, spiraling prices due to geopolitical events pushed the cost of living to the forefront of public concerns. Inflation peaked at 8% shortly after Russia’s invasion of Ukraine. As voter priorities shifted, over 50% of Australians named cost-of-living as the government’s top policy concern by mid-2023.

Interestingly, as inflation showed signs of easing, with a drop to 1.9% in mid-2023, the focus remained on living costs. Economists argue this reaction is more of a narrative than a reflection of the true financial state of most households. KPMG recently noted that the average Australian household’s net worth has increased by over 50% in the past five years.

Government Response and Future Implications

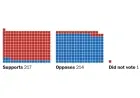

The persistent worry about the cost of living has influenced government policies. Politicians face pressure to implement cost-of-living relief, which sometimes leads to inefficient financial aid strategies. For instance, a recent federal budget allocated $150 in electricity bill relief to all households, costing $1.8 billion, which could have been better spent on low-income families facing acute financial difficulties.

This preoccupation with cost-of-living issues has overshadowed other critical economic discussions, such as productivity improvement, wealth inequality, and the transition to clean energy. A 2024 Ipsos survey revealed that only 8% of voters felt well-informed about Australia’s net-zero commitments, although renewable energy comprised nearly 40% of electricity generation that year.

As the political narrative continues to focus heavily on living costs, economists stress the importance of also tackling other significant economic challenges. Balancing these discussions is essential for creating a resilient and equitable economic future.