Scandal Engulfs Personal Injury Attorney, Prompts Trust Fund Investigation

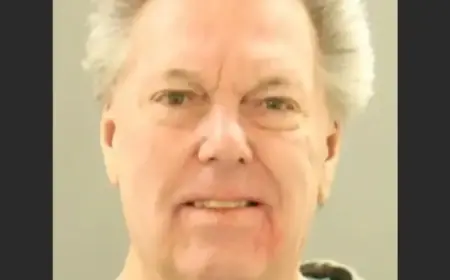

A recent scandal involving a personal injury attorney has raised alarms about the integrity of client trust funds. David Lee Pettus, a former attorney from Houston, was arrested in Texas due to a warrant related to nearly $100,000 in unpaid casino credit in Las Vegas. This event follows the acceptance of his resignation by the Texas Supreme Court, highlighting significant issues in the legal and financial sectors of personal injury law.

Implications of the Scandal on Trust Funds

The arrest of Pettus underscores urgent concerns regarding the management of client trust accounts, which are crucial for safeguarding settlement funds and ensuring prompt medical lien payments. When these controls are compromised, victims may experience delays and financial shortfalls.

Challenges for Attorneys and Funders

- Personal injury attorneys must maintain active bar status and a clean disciplinary history.

- Financial distress poses additional risks for legal professionals.

- Litigation funders may face extended timelines for recovery and reduced collections.

As investigations progress, there may be triggers for escrow holds, oversight from courts, and comprehensive audits. Vigilance in monitoring bank confirmations and disbursement trails is now more critical than ever.

Investor and Insurer Reactions

The misconduct of attorneys like Pettus amplifies risks for litigation finance and insurance sectors. Courts may intervene by freezing assets and prioritizing client payments over other disbursements.

Strategies for Managing Risk

- Anticipate longer recovery periods and increased legal expenses.

- Implement tighter pricing models and enhanced documentation procedures.

- Require trusted ledgers and verified lien releases for transactions.

Strategies can also include contingency plans to protect clients in case of adverse bar actions, ensuring that attorney misconduct does not further jeopardize client funds.

Best Practices for Law Firms and Funders

To mitigate risks, law firms should adopt several best practices:

- Segregate client trust accounts and reconcile them daily.

- Utilize dual approval mechanisms for all disbursements.

- Conduct independent quarterly audits and employ real-time alerts for cash transfers.

It is essential to monitor for any lifestyle indicators that could suggest dubious financial behavior, such as significant casino debts or unexplained cash withdrawals. Proper documentation of settlements and lien satisfaction must remain transparent to protect against potential fraud.

Conclusion

The case of David Lee Pettus serves as a crucial reminder that the safety of client funds relies heavily on strict adherence to controls and robust oversight. Investors and insurers must implement rigorous measures to validate trust account balances and carefully monitor compliance practices. By prioritizing client repayments and ensuring thorough documentation, stakeholders can reduce risks associated with personal injury attorney scandals while safeguarding investments and enhancing recovery outcomes.

FAQ

How does a personal injury attorney scandal impact investors?

Such a scandal often leads to delays in payouts tied to settled claims, affecting funders and insurers through escrow holds and potential disputes over payments.

What measures protect client trust accounts?

Segregated accounts, daily reconciliations, dual approval for disbursements, and independent audits are fundamental protections. Clear documentation helps mitigate fraud risk.

How should funders adjust pricing in light of litigation finance risks?

Pricing should be adjusted upward to account for longer timelines and potential deficits while requiring verified trust accounts and lien payoffs to minimize risk exposure.

What are common signs of attorney misconduct?

Indicators may include inconsistent trust account reconciliations, suspicious cash withdrawals, and unresolved bar complaints. Prompt action should be taken upon identifying these red flags to protect client interests.