BNP Paribas: Oracle’s Financing Announcement Marks Key ‘Clearing Event’ (ORCL:NYSE)

BNP Paribas has identified Oracle’s recent financing announcement as a significant “clearing event” for the company’s shares. This statement comes as Oracle, a prominent player in the technology sector, unveiled plans related to its equity and debt financing for 2026.

Oracle’s Financing Plans for 2026

Oracle’s announcement focuses on two key areas: equity financing and debt restructuring. Analysts believe that these moves can serve as a catalyst for stock performance moving forward.

Key Aspects of the Announcement

- Equity Financing: The plan specifies how Oracle aims to secure capital through equity markets.

- Debt Financing: Oracle intends to address its debt obligations more efficiently.

Implications for Investors

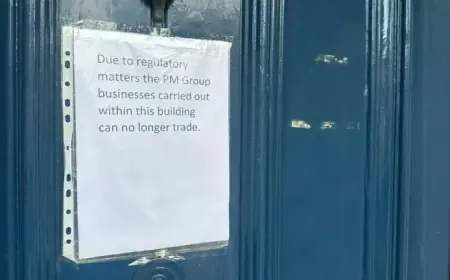

BNP Paribas suggests that this financing strategy could stabilize Oracle’s stock price. Investors may perceive this as a proactive approach to managing the company’s financial health.

Market Reactions

The market has responded positively to Oracle’s announcement, reflecting increased investor confidence. Analysts recommend monitoring Oracle’s stock for developments as financing plans unfold.

Ultimately, this financing announcement from Oracle is seen as a critical moment for its shares. As developments in their financing strategy proceed, stakeholders will be keen to observe the potential implications for Oracle’s stock trajectory.