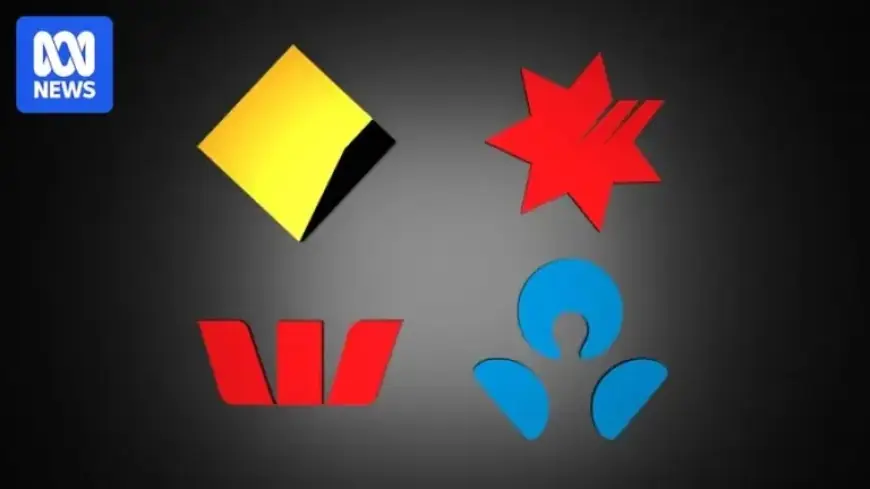

Major Banks React to RBA’s Interest Rate Increase

Australia’s major banks are responding swiftly to the Reserve Bank of Australia’s (RBA) recent interest rate hike. This marks the first increase in four years, with the RBA raising rates by 0.25%. The cash rate now stands at 3.85% following significant inflation increases in the latter half of 2025.

Details of the Interest Rate Increase

The Reserve Bank of Australia has adjusted the cash rate from 3.60% to 3.85%. This decision was driven by a notable surge in inflation. The RBA aims to mitigate rising costs affecting consumers and the economy.

Major Bank Announcements

- Commonwealth Bank: All variable home loan interest rates will rise by 0.25% per annum. The change will take effect on February 13, 2026.

- Bank Executives’ Comments: Angus Sullivan, executive of CBA’s retail banking group, emphasized the bank’s commitment to supporting home loan customers during this transition.

Impact on Consumers

The RBA’s decision and subsequent actions by banks are likely to heighten financial pressure on borrowers. The increase in interest rates will affect monthly repayments for many homeowners.

As Australia’s economy adapts to new challenges, major banks are expected to monitor these changes closely. They are poised to offer assistance and guidance to help customers navigate the evolving financial landscape.

For regular updates on financial news and insights, visit Filmogaz.com.