Gold Price Forecast: Market Seeks Value Post Sharp Selloff

Gold prices faced a significant decline recently, with XAUUSD trading at $4,793.49, marking a drop of 2.08% or $101.94. This swift sell-off has left traders analyzing the market for potential recovery points.

Gold Price Forecast: Market Seeks Value Post Sharp Selloff

Traders are eyeing a critical range between $5,002 and $5,144 as the next battleground for gold prices. If the market stabilizes within this zone, it will prompt traders to decide between initiating short positions or anticipating a potential upside breakout.

Key Levels to Watch

- Current Trading Price: $4,793.49

- Recent Decline: $101.94 (-2.08%)

- Next Potential Range: $5,002 to $5,144

Market analysts suggest the recent downturn may indicate long liquidation following a major price peak. Historically, the first leg down after a top typically involves extensive liquidations. Once this phase concludes, a retracement of 50% to 61.8% is expected before market direction is clarified.

Market Dynamics and Speculation

The testing of the $5,002 to $5,144 retracement zone could result in a decisive move. A failure to surpass $5,143.89 may result in increased selling pressure. Conversely, a breakthrough could signal renewed interest from buyers.

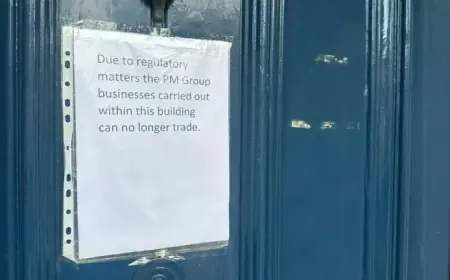

Despite the recent downturn, the underlying sentiment remains bullish. However, speculation played a considerable role in driving prices up too rapidly. A recent nomination of Kevin Warsh as a potential U.S. Federal Reserve Chair has been linked to the sell-off, though other factors contributed as well. The Federal Reserve’s monetary policy statement and a margin hike from the CME Group also prompted significant market liquidation.

Looking Ahead

Moving forward, it is essential for traders to differentiate between speculative trading and genuine buying interest. A solid support base above the 50-day moving average would suggest the presence of real buyers, setting the stage for a more stable recovery in gold prices.