India Gold Rates Update: February 2

Gold prices in India experienced a notable decline on February 2, 2023. The price per gram dropped to 13,608.64 Indian Rupees (INR), a decrease from 14,320.78 INR just two days prior. Similarly, the cost per tola fell to 158,629.30 INR from the previous 167,017.50 INR.

Current Gold Prices in India

The updated gold prices as of February 2, 2023, are summarized below:

| Unit Measure | Gold Price (INR) |

|---|---|

| 1 Gram | 13,608.64 |

| 10 Grams | 135,995.40 |

| Tola | 158,629.30 |

| Troy Ounce | 423,288.20 |

These prices reflect the adjustments made based on international market rates and currency adaptions, specifically USD to INR. They are subject to change and should be viewed as reference points, as local rates may vary slightly.

Gold’s Role and Market Dynamics

Gold is a significant asset historically revered as a store of value and used widely in jewelry. It is also appreciated for its potential as a safe-haven investment during economic instability.

- Gold serves as a hedge against inflation.

- It offers protection against currency depreciation.

- Central banks often increase gold reserves to stabilize their economies.

In 2022, central banks added a remarkable 1,136 tonnes of gold to their reserves, valued at approximately $70 billion. This figure marks the highest annual purchase since record-keeping began. Notably, nations like China, India, and Turkey are rapidly expanding their gold holdings.

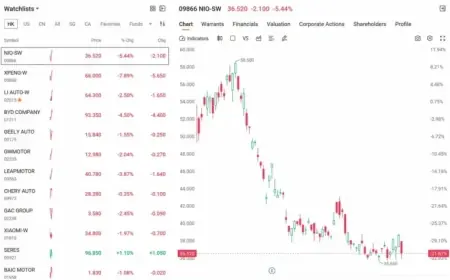

Influencing Factors on Gold Prices

The price of gold responds to a variety of economic factors. Typically, gold prices rise during periods of geopolitical tension or significant economic downturns. Furthermore, its value interacts inversely with the US Dollar and other risk assets.

- A depreciating US Dollar often leads to increased gold prices.

- Higher interest rates generally exert downward pressure on gold prices.

- Stock market fluctuations can impact gold’s attractiveness as an investment.

As a non-yielding asset, gold tends to flourish in low-interest environments. Observers note that the movements in gold prices are significantly influenced by the performance of the US Dollar and broader economic conditions.