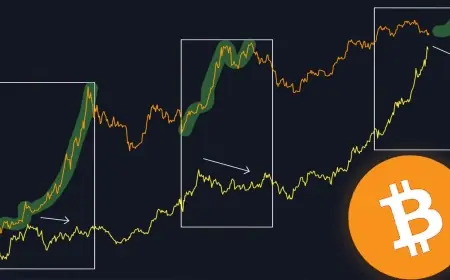

Global Market Collapse: Bitcoin and More Face Trillions in Losses

The recent global market collapse has seen significant financial losses, particularly in assets like Bitcoin and gold. As of January 29, 2023, this downturn was characterized by extreme volatility in various sectors, including cryptocurrencies and traditional equities.

Market Overview

At approximately 09:30 EST, just as the US stock market opened, investors felt the brunt of a rapid market sell-off. Bitcoin fell below $85,000, reaching an intraday low of $84,365. This represented a decline of about 5.4% on that day alone.

Market Statistics

- Bitcoin: Dropped to $84,434, down 5.4%.

- Gold: Fell approximately 5.8%.

- Silver: Decreased by over 6%.

- Oil: Increased about 3%.

- Dollar Index: Rose around 0.3%.

This chaotic trading environment sent shockwaves across various asset classes. The S&P 500 e-mini futures were down roughly 1.1%, which added further pressure on risk assets, including cryptocurrencies.

Reasons Behind the Collapse

The day began with rising concerns over US-Iran tensions, which significantly impacted oil prices. Brent crude soared above $71 per barrel, creating inflationary worries that affected investor sentiment across the board.

Liquidity Issues

The sudden market collapse was illustrative of what traders termed a “liquidity wins” moment. Many investors who had taken long positions quickly found themselves under pressure as the market shifted dramatically within the first hour of trading.

Forced Liquidations

As fear gripped the market, leveraged positions were liquidated rapidly. According to data from Coinglass, over $800 million in margin liquidations occurred, with approximately $691 million taken from long positions following the downturn.

Gold’s Unexpected Drop

The performance of gold, typically viewed as a safe haven, was notably counterintuitive. Gold prices retraced from a record high of around $5,602 per ounce to approximately $5,100. This downturn resulted in a projected market capitalization reduction of about $2 trillion.

Outlook and Future Indicators

Looking ahead, the stability of Bitcoin and other assets hinges on several crucial developments. Traders will be observing Bitcoin for signs of recovery following the recent liquidation waves. If the cryptocurrency can regain its footing, it might suggest a potential stabilization in the broader market.

Key Factors to Monitor

- Bitcoin’s price recovery: A bounce back indicates potential stabilization.

- Oil price movements: Sustained increases may signal ongoing risk.

- The strength of the US dollar: A firm dollar could restrict liquidity and risk appetite.

Overall, traders are advised to remain vigilant for any verified news, particularly regarding geopolitical tensions. Should escalations arise, markets could see further impacts, reinforcing existing trends or triggering new waves of volatility.

As this situation continues to develop, ongoing assessments will be necessary to navigate the complexities of the market effectively.