Gold price today plunges after Warsh Fed pick; Gold price predictions shift

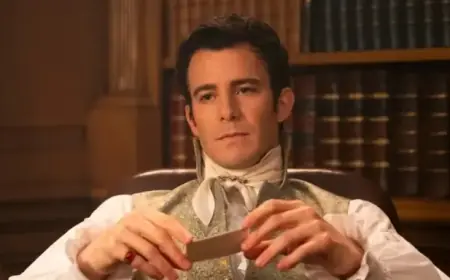

Gold price today is sharply lower on Friday, Jan. 30, 2026, after a historic two-day swing that took bullion from a fresh record to its steepest one-day drop in decades. The reversal came as the U.S. dollar strengthened and traders unwound crowded positions following President Donald Trump’s nomination of Kevin Warsh to lead the Federal Reserve when Jerome Powell’s chair term ends in May 2026.

The selloff has pushed investors to a different kind of debate: less “how high can it go next week” and more “what set of conditions keeps gold elevated through 2026.”

Gold price today: the key levels and timing

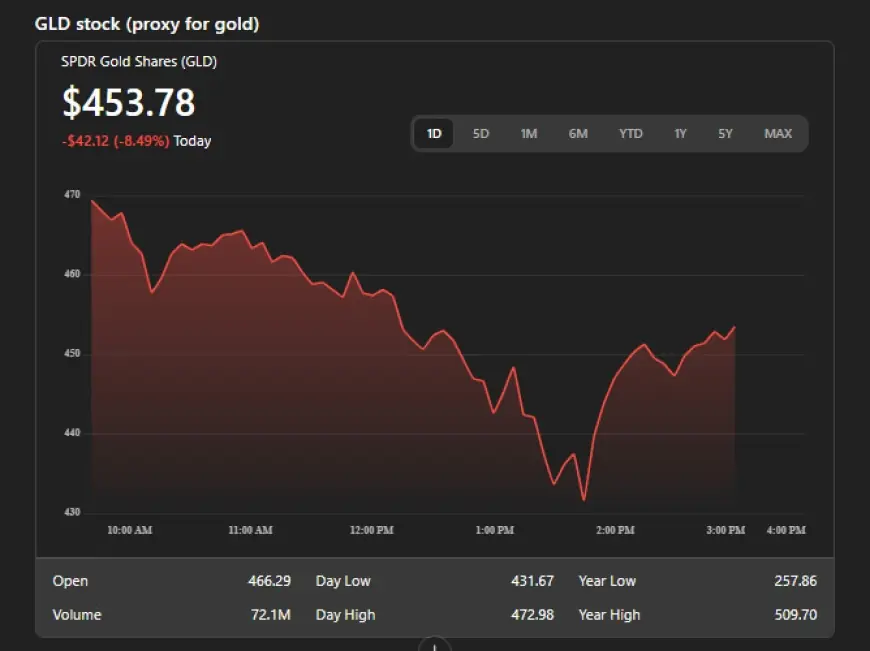

By late morning trading in the U.S., spot gold was down hard from Thursday’s peak, briefly slicing under $5,000 before stabilizing above that round-number area at times. The move has been mirrored in derivatives and popular proxies, with futures and gold ETFs experiencing outsized intraday ranges.

| Market measure | Level | Timestamp (ET) |

|---|---|---|

| Spot gold (XAU/USD) | $4,883.62/oz (down ~9.5% on the day) | late morning |

| Spot gold record high | $5,594.82/oz | Thu, Jan. 29 |

| COMEX gold futures (Feb) settle | $4,745.10/oz (down ~11.4%) | Fri close |

| GLD (SPDR Gold Shares) | $454.79 (intraday $431.67–$472.98) | 2:57 p.m. |

Even with Friday’s drop, gold remains substantially higher for January, after a month defined by relentless safe-haven buying and speculative momentum.

Why the market snapped: dollar strength and position unwind

Friday’s shock move has two overlapping drivers.

First, the Fed-chair nomination changed the day’s macro tone. Warsh, a former Fed governor, has been viewed by many market participants as reinforcing a narrative that the Fed retains institutional independence, and that future policy may not bend as easily to political pressure. That interpretation helped the dollar rebound, a typical headwind for gold because it raises the metal’s cost in non-dollar terms.

Second, this was a textbook “crowded trade” unwind. After weeks of accelerating gains, many investors and systematic strategies were positioned for higher prices. When momentum flipped, the selling became self-reinforcing—profit-taking, stop-loss triggers, and leverage reduction—creating the kind of air-pocket drop that can produce multi-hundred-dollar intraday swings.

What today’s plunge signals for February trading

Violent reversals tend to change the market’s character, at least temporarily. Two-way volatility can remain elevated even if the broader trend stays intact. In practical terms, traders will be watching:

-

Whether spot gold can consistently reclaim and hold the $5,000 area after briefly breaking below it.

-

Whether the dollar’s rebound holds into next week.

-

Whether futures basis and liquidity normalize after a session where the front-month contract fell even more than spot.

If volatility cools and prices stabilize, gold may transition from a momentum market into a range market—still high, but more sensitive to incremental shifts in rates and risk sentiment.

Gold price predictions: three scenario lanes for 2026

With “Gold price predictions” back in focus, strategists are increasingly framing 2026 as scenario-dependent rather than a single-point forecast.

One widely cited base-case view is “historically high but choppy,” where gold remains supported by a mix of geopolitical uncertainty, debt concerns, and uneven global growth—yet struggles to extend gains in a straight line if conditions don’t deteriorate further.

A second lane is moderate upside if growth slows and interest rates fall further than markets expect. In that environment, lower real yields can improve the relative appeal of gold, particularly if risk assets wobble.

A third lane is cooling later in 2026 if major risk pillars fade. Citi has argued that a meaningful share of today’s geopolitical and macro risk support could lessen by the end of 2026—examples frequently cited include a de-escalation in major conflicts or reduced geopolitical flashpoints—potentially removing some of the urgency behind safe-haven allocations.

None of these lanes requires a new “gold story.” They hinge on observable variables: the path of rates, the dollar, the intensity of geopolitical risk, and the persistence of investor demand.

What to watch next for forecasts that matter

For the next few months, the most actionable signals for predictions are mechanical and measurable:

Central bank and investor demand trends remain crucial. The World Gold Council has highlighted that official-sector buying and investment flows can keep prices elevated even when jewelry demand softens. If ETF inflows return after a volatility shock, that would reinforce the “supported but choppy” view.

Rate expectations are the other key input. If markets move toward fewer or slower cuts, or if real yields rise, gold can face pressure even with supportive long-term narratives. If the opposite happens—cuts arrive faster, or growth deteriorates—gold’s downside may be limited and rebounds can come quickly.

The near-term takeaway from Friday is not that the gold thesis vanished; it’s that the market had become stretched, and 2026 forecasting is shifting from linear targets to conditional outcomes.

Sources consulted: Reuters; CME Group; World Gold Council; Citi Research; Barron’s.