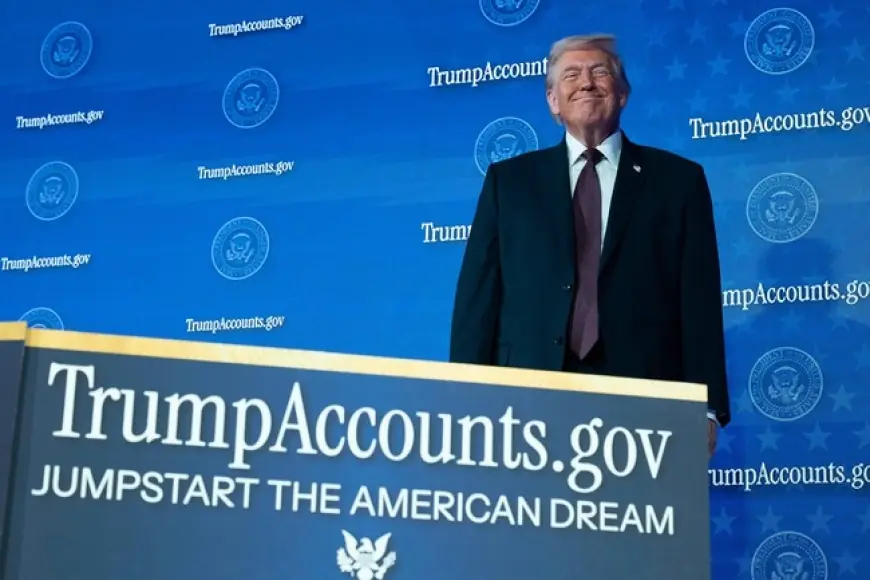

Trump Accounts for Kids: New $1,000 Seeded Investment Accounts Near Launch as Families, Employers, and Donors Line Up

A new federally created savings-and-investing program branded “Trump Accounts” is moving from legislative text into real-world rollout, setting up a high-profile test of whether asset-building can be scaled nationally for children without widening inequality. The core promise is simple: eligible newborns receive a one-time $1,000 government contribution into a tax-advantaged account, with families, employers, and other contributors allowed to add more over time under strict rules.

The mechanics, however, are anything but simple. As tax season turns into enrollment season, parents are being told to make elections that will allow accounts to be created and funded when the program goes live. The program’s first deposits are not expected until the summer, giving policymakers, financial firms, and employers a narrow window to make the rollout smooth enough to avoid early backlash.

What Are Trump Accounts for Kids, Exactly?

Trump Accounts are a child-owned account structured like a traditional individual retirement account with special restrictions while the child is a minor. The child is the account beneficiary and legal owner, while an adult acts as the responsible party until adulthood.

Key design features include:

-

A pilot contribution of $1,000 for eligible newborns, tied to a specific birth-date window

-

An annual contribution cap for most non-government contributions during childhood

-

Tight investment rules during the child’s “growth period,” aimed at low-cost, broad-market exposure

-

Limited or prohibited withdrawals before adulthood, with narrow exceptions

The program is built around the idea that starting early, even with a modest seed amount, can create a meaningful financial cushion through compounding over time.

The Launch Date That Matters: July 4, 2026 ET

The operational timeline is central to the story. Contributions generally cannot be made before July 4, 2026 ET, and the government’s $1,000 pilot deposits are scheduled no earlier than that date as well. Elections to establish an account can be made ahead of time through tax-related processes, so that accounts are ready to receive funds when contributions are permitted.

That sequencing is deliberate: it lets the federal government build the administrative pipeline first, then turn on the money flow once accounts and trustees are in place.

Who Qualifies for the $1,000 and How Much More Can Be Added?

The $1,000 seed is limited to children born within a defined eligibility window, and it is triggered by an election that links the child’s identity to an account created for that purpose.

Beyond the seed, Trump Accounts are designed to accept contributions from multiple sources, including:

-

Parents, relatives, and other individuals

-

Employer programs that choose to contribute for employees’ children

-

Certain government, state, tribal, and charitable funding pools that can be distributed to qualified classes of kids

During the growth period, most private and employer contributions are subject to an annual aggregate limit of $5,000, with inflation adjustments anticipated later. The program’s structure encourages broad participation but caps the pace at which wealthier households can “supercharge” the account during childhood.

Behind the Headline: Why This Policy Is Politically Potent

Trump Accounts sit at the intersection of ideology and finance. Instead of recurring cash benefits, the program emphasizes ownership and market participation. That framing creates clear incentives for the key actors:

-

The administration gets a highly marketable message: every eligible newborn starts life with an investment stake.

-

Employers get a new benefits lever that can be positioned as family support and talent retention.

-

Financial firms get long-duration accounts that could keep customers in their ecosystem for decades.

-

Philanthropists get a visible, scalable vehicle for targeted giving to children in selected communities.

Just as important are the constraints. The investment limits and fee caps are designed to avoid high-cost products and speculative exposure, but they also reduce flexibility and may frustrate families who want more tailored choices.

Stakeholders and the Real Risks

The winners and losers will depend on uptake and follow-through.

Families with stable income and strong financial literacy are best positioned to contribute consistently and keep the account invested. Families living paycheck to paycheck may receive the $1,000 seed yet struggle to add more, potentially creating a two-tier outcome where the headline is universal but the long-term benefit is uneven.

Meanwhile, employers’ involvement could become a dividing line. If large companies broadly match contributions while smaller employers cannot, the program may deepen disparities along job-quality lines.

There is also market risk. Even broad index exposure can have multi-year drawdowns, and a program tied to equity performance will inevitably face political pressure during downturns.

What We Still Don’t Know

Several missing pieces will determine whether Trump Accounts become a durable policy or a controversy magnet:

-

How simple the election and account-opening process will be for families with limited tax support

-

How quickly trustees can open accounts and invest deposits once funding begins

-

What guardrails will be used to reduce fraud and identity errors at scale

-

Whether policymakers will expand eligibility, extend the newborn window, or add supplemental support for low-income families

Implementation details will matter as much as the headline benefits. If the rollout is confusing, the program risks becoming synonymous with red tape rather than opportunity.

What Happens Next: 5 Realistic Scenarios to Watch

-

Rapid adoption in 2026

Trigger: a smooth enrollment experience and aggressive employer matching. -

Uneven outcomes and equity backlash

Trigger: contribution patterns show the largest gains accruing to higher-income families. -

A corporate match arms race

Trigger: major employers compete publicly by offering richer contribution programs. -

Administrative friction slows momentum

Trigger: delays, identity mismatches, or trustee bottlenecks create early frustration. -

A policy revision push in 2027

Trigger: lawmakers respond to early data with eligibility changes, higher seed funding, or targeted add-ons.

Why It Matters

Trump Accounts are a bet that national wealth-building can start at birth and scale through a mix of public seed money and private participation. If the program launches cleanly and attracts broad, sustained contributions, it could reshape how families think about saving for education, housing, and early adulthood. If it becomes lopsided, confusing, or politically polarizing, it could harden skepticism about using market-linked tools as social policy. Either way, July 4, 2026 ET is set to be the moment this experiment stops being an idea and starts being measurable.