CAT Stock Rises on the Radar as Investors Reprice “Old Economy” Cyclicals

CAT stock is back in focus as markets reassess how long construction, mining, and energy demand can stay resilient in a higher-rate world. Caterpillar is often treated as a bellwether for heavy industry, so even routine shifts in economic expectations can move the shares quickly.

Investors are weighing a familiar mix of positives and pressure points: infrastructure work that can underpin equipment demand, commodity-linked spending cycles, and the risk that tighter financing conditions slow big-ticket purchases. Further specifics were not immediately available on the near-term order pace across every end market, and the company has not publicly disclosed a unified, real-time picture of dealer inventories across all regions.

Why CAT stock is getting attention right now

Caterpillar sits at the intersection of several narratives that tend to dominate market cycles: the health of global construction activity, the direction of commodity prices, and the willingness of businesses to spend on long-lived equipment. When investors feel better about growth, cyclicals like Caterpillar often catch bids; when recession fears rise, they can sell off fast.

Another reason the stock draws outsized attention is its visibility in “real economy” spending. Heavy equipment orders are not impulse buys. They tend to reflect multi-quarter planning, project pipelines, and confidence in utilization rates. That makes CAT stock a proxy for broader business sentiment, especially for investors who want exposure to industrial activity without owning smaller, more volatile suppliers.

At the same time, headline risk can matter. Tariffs, labor dynamics, and shifting demand from large overseas markets can all add day-to-day volatility even when the long-term thesis is unchanged. Some specifics have not been publicly clarified about how quickly certain supply chain and delivery timing patterns are normalizing across every product category.

How Caterpillar’s business fundamentals usually translate into stock moves

Caterpillar’s shares typically react to a few recurring indicators. First is pricing power, often discussed as whether the company can raise prices faster than its input costs. Second is backlog and order quality, which investors treat as a window into future revenue and factory utilization. Third is operating margin, because small changes in efficiency can have an outsized effect on profit for large manufacturers.

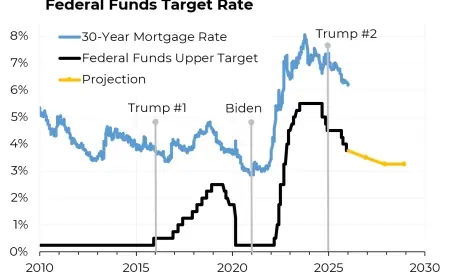

Mechanically, the stock market looks forward. Traders and long-term investors are not only responding to current sales but also to guidance, dealer inventory levels, and whether end customers appear to be pulling forward purchases or pausing. In cyclical industries, the question is rarely “Are results good?” but “Are they peaking, stabilizing, or weakening?” That’s why the same earnings numbers can trigger a rally one quarter and a selloff the next, depending on what they signal about the next six to twelve months.

Capital returns can also shape sentiment. For many shareholders, Caterpillar’s dividend and share repurchases are part of the appeal, particularly when growth is steady but not explosive. If investors believe cash flows are durable, the market may reward consistent payouts; if cash flows are perceived to be at risk, the stock can reprice quickly.

The debate investors keep having: soft landing, hard landing, or something in between

The bull case often leans on the idea that demand is diversified across construction, resource industries, and services. Even if one end market cools, another can pick up some slack. Service and parts revenue can also soften the blow when new equipment sales slow, because fleets still need maintenance and repairs.

The bear case centers on cyclicality and financing. High interest rates can make equipment purchases more expensive, and lenders can tighten credit when economic uncertainty rises. Commodity swings add another layer, since mining and energy spending can shift rapidly with price expectations. There is also the risk of dealer inventory normalization: if channel inventories are elevated, new orders can slow as dealers sell through existing machines.

Key terms have not been disclosed publicly regarding how different customer segments are negotiating purchase timing and financing in the current environment, and a full public timeline has not been released for when any regional slowdowns might become visible in reported results.

Who feels the impact beyond shareholders

CAT stock moves don’t just affect traders. Construction contractors and infrastructure builders pay attention because equipment availability and pricing can influence project timelines and bids. Mining operators watch it because replacement cycles and fleet upgrades are tied to productivity and safety targets. Dealers and independent service shops feel shifts in demand through service volumes, parts orders, and used-equipment pricing.

Employees and suppliers are also stakeholders. A sustained upswing can mean steadier production schedules and capital investment, while a downturn can translate into tighter cost controls across the ecosystem. And for retirement savers holding broad market or industrial-sector funds, CAT stock performance can influence portfolio returns more than many realize due to its size and visibility.

The next major catalyst is Caterpillar’s next quarterly earnings report and forward guidance, which will be scrutinized for order trends, margins, and any signal on how customers are pacing equipment purchases into the next cycle.