Corning Shares Surge: Discover the Reason Behind Today’s Rise

Corning’s recent surge in stock price correlates with a significant partnership aimed at enhancing AI infrastructure. Shares of the glass maker rose over 15% following a $6 billion deal with Meta Platforms.

Corning and Meta Partnership

The agreement means Corning will provide Meta with advanced optical fiber, cables, and connectivity products. This collaboration is designed to expedite the construction of AI data centers, crucial for Meta as it competes in the rapidly evolving tech landscape.

Key Financial Information

| Key Indicator | Value |

|---|---|

| Current Price | $104.60 |

| Market Cap | $94B |

| Day’s Range | $103.77 – $112.84 |

| 52-week Range | $37.31 – $113.99 |

| Volume | 796K |

| Average Volume | 6.6M |

| Gross Margin | 34.72% |

| Dividend Yield | 1.02% |

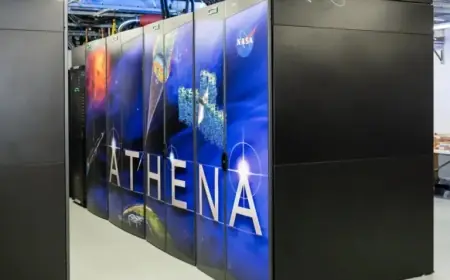

Expanding Manufacturing Capacity

To meet the growing demand driven by AI, Corning plans to expand its manufacturing operations in North Carolina. The company will collaborate with Meta at its optical cable facility in Hickory. This plant is expected to become the largest of its kind in the U.S.

Wendell Weeks, Corning’s CEO, emphasized the significance of this development. “Building advanced data centers in the U.S. requires world-class partners and American manufacturing,” said Joel Kaplan, a Meta executive. The partnership highlights both companies’ commitment to high-performance fiber optic technology necessary for AI infrastructure.

Business Growth

- Corning’s optical communications revenue increased by 58% year over year in Q3.

- The surge is largely driven by demand for generative AI products.

This partnership illustrates Corning’s strategic focus on leveraging AI opportunities and meeting market demands. With robust growth in the AI sector, the future appears promising for both Corning and its collaborations.