Ontario Man Loses $260,000 in Pump-and-Dump Scam Fraud

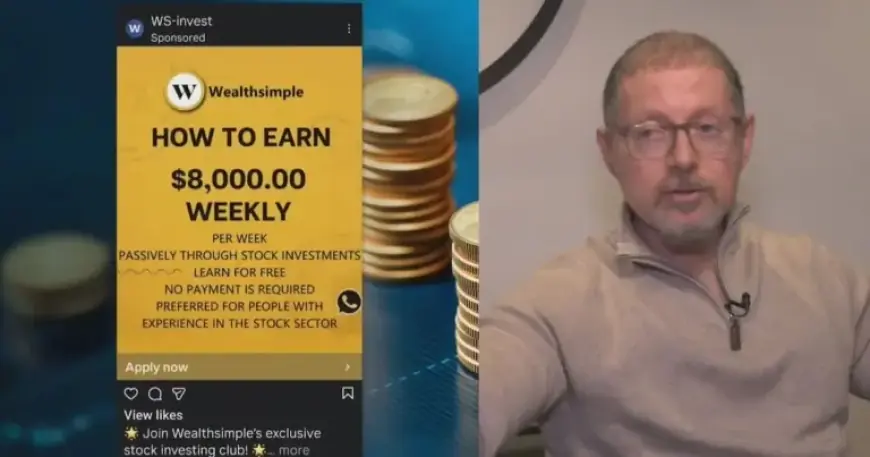

An alarming case of investment fraud has come to light, involving an Ontario man who lost a staggering $260,000 in a pump-and-dump scam. Israel Klait, a resident of Richmond Hill, fell victim to this fraudulent scheme after switching his investments to Wealthsimple, a prominent Canadian financial services platform. This incident highlights the growing threat of such scams and the need for investors to exercise caution in the digital age.

Understanding Pump-and-Dump Scams

Pump-and-dump scams occur when fraudsters artificially inflate the price of a stock, generating excitement through deceptive means, only to sell their shares once the price peaks, leaving investors with devalued stocks.

The Incident

After moving his investments to Wealthsimple, Klait began seeing ads on Instagram promoting a trading forum that appeared to be affiliated with the platform. Believing these advertisements were legitimate, he joined the group and received a stock recommendation.

- Initial investment resulted in a profit of $14,000.

- Trapped in a second investment, Klait lost $260,000.

Klait’s confidence led him to invest more heavily after his initial success. However, soon after purchasing a stock priced at $1.68, its value plummeted to just ten cents within minutes. Panicking, he realized he was a victim of a pump-and-dump scheme.

An Unfortunate Discovery

After the loss, Klait attempted to re-enter the trading forum but found the group had vanished. All communications and contact information were deleted, leaving him with no recourse. Concerned for other investors, Klait reached out to CTV News, expressing that Wealthsimple should have warned clients about these scams.

Wealthsimple Responds

A spokesperson from Wealthsimple addressed the matter, acknowledging the rise of aggressive and sophisticated social media scams. They emphasized the company’s commitment to client safety and their efforts to report fraudulent advertisements actively.

- Over 10,000 fraudulent ads reported in three months.

- Collaboration with law enforcement and industry groups to combat scams.

- Warnings and alerts deployed to clients regularly.

Wealthsimple advised investors to remain cautious about financial offers that seem too good to be true. They do not endorse specific stocks and continuously strive to enhance tools to protect their clients.

The Aftermath of the Scam

Klait’s experience serves as a warning to others. Losing $260,000 has forced him to reassess his retirement plans and left him emotionally distressed. He now emphasizes the importance of skepticism regarding investment opportunities, particularly those promoted on social media.

As scammers become increasingly sophisticated, it is crucial for investors to be vigilant and conduct thorough research before making financial decisions. Awareness and caution can prevent devastating financial losses in the future.