Zijin Gold Acquires Canadian Allied Gold for $4 Billion

Zijin Gold, a major player in the mining industry, has announced its acquisition of Canadian company Allied Gold for approximately C$5.5 billion, equivalent to $4.02 billion. This strategic move is part of Zijin’s ambitious global expansion efforts, driven by a surge in gold prices.

Zijin Gold’s Strategic Acquisition of Allied Gold

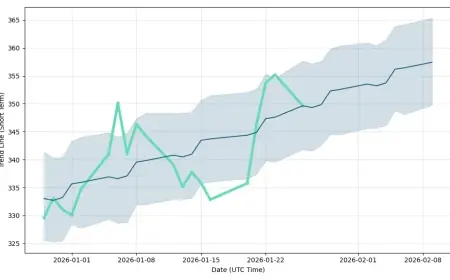

The acquisition price translates to C$44 per share for Allied Gold, reflecting a premium of about 5.4% over the company’s previous closing stock price. This offer comes as both companies see significant opportunity for growth in an industry benefiting from high gold prices.

Industry Context

The mining sector is witnessing a wave of consolidation as larger companies seek to enhance their production capabilities. With rising gold prices augmenting miners’ margins, acquisitions like this provide an alternative to developing new mining sites.

- Zijin will pay C$220 million to Allied if the deal is canceled under specific conditions.

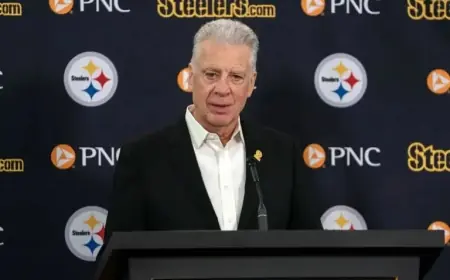

- Allied’s CEO, Peter Marrone, stated that this deal offers substantial value for shareholders.

- The transaction is projected to close by late April 2026.

Geopolitical Considerations

This acquisition also unfolds against the backdrop of improving relations between Canada and China. Recently, both countries reached a preliminary agreement to reduce tariffs on products such as electric vehicles and canola, aiming to foster trade relations.

Zijin Gold’s Global Footprint

Zijin operates across nine countries and made a notable entry into the Hong Kong market last year. The company has seen growth opportunities through a strategic focus on expanding its asset portfolio amid favorable market conditions.

As fiscal landscapes continue to shift, the consolidation of assets in the mining sector will likely remain a prominent trend. Alliances formed under such circumstances may redefine the industry landscape for years to come.