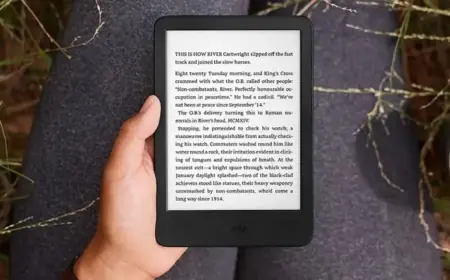

Major Shareholder Invests $5 Million in Struggling Small-Cap Stock

A significant investment has been made in the small-cap stock market, highlighting the potential for recovering companies. Recently, Ed Kernaghan, a major shareholder, invested $5 million in Mattr Corp. (MATR-T), showcasing confidence in a challenging business environment.

Investment Details in Mattr Corp.

Between January 8 and January 22, Kernaghan acquired 605,100 shares in Mattr Corp. This purchase was made across multiple accounts, with an average cost of $8.15 per share. The total expenditure for these transactions reached nearly $5 million, excluding any trading fees.

Market Response and Recent Performance

Mattr Corp.’s financial performance has raised concerns among investors. On November 12, the company released its third-quarter financial results, which did not meet market expectations. Following this report, the stock’s price dropped over 20% the next day, accompanied by high trading volume.

Recent Insider Selling Activities

While Mattr Corp. saw a significant investment, several companies experienced insider selling activities. Below are notable transactions:

- Almonty Industries Inc. (AII-T)

- Director Mark Trachuk sold 111,000 shares on January 21.

- Average price per share was approximately $9.90.

- Proceeds from the sale totaled nearly $1.1 million, excluding commissions.

- Fortuna Mining Corp. (FVI-T)

- President and CEO Jorge Ganoza sold 25,000 shares on January 16.

- The average selling price was $10.31 per share.

- This transaction generated over $257,000, not including fees.

- Peyto Exploration and Development Corp. (PEY-T)

- Vice President Lee Curran exercised options for 83,000 shares between January 13-16.

- Selling price per share was approximately $22.81.

- Net proceeds from this sale surpassed $712,000, excluding transaction costs.

As the small-cap stock market continues to experience fluctuations, insider trading activity remains a significant indicator of investor sentiment and potential future performance. Keeping an eye on these movements can provide crucial insights for making informed investment decisions.