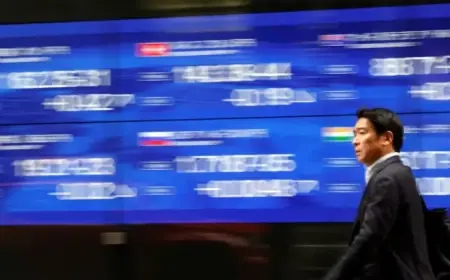

Gold Prices Surge Past $5,000 as Investors Seek Safe Haven

Gold prices have surged past $5,000 an ounce, marking a significant milestone in the market. This latest increase is part of a broader movement, with investors gravitating towards this safe-haven asset amid escalating geopolitical tensions.

Record Surge in Gold Prices

As of today, spot gold reached $5,071 per ounce, reflecting a 1.8% increase by 1:10 PM AEDT. Concurrently, US gold futures for February delivery rose by 1.9% to $5,073 per ounce. This upward trend positions prices over 16% higher for the year.

- Gold price in Australian dollars approximately $7,325.

- Forecast suggests gold may peak at around $5,500 later this year.

Market Drivers

Several key factors are contributing to the current gold rally. Investors are motivated by:

- Geopolitical uncertainties, particularly rising tensions involving the United States and NATO.

- Continued easing of US monetary policy.

- Strong demand from central banks, with notable purchases by China.

- Record inflows into exchange-traded funds (ETFs).

Exploration Investment Growth

The unprecedented prices have spurred significant investment in gold exploration across Australia. Analysts like Philip Newman from Metals Focus predict further price increases, though some pullbacks may occur as investors take profits.

Increased Retail Demand

Retail demand remains strong, with Australian bullion sellers reporting lengthy queues. Thousands of customers have visited the Perth Mint weekly in October. This trend has persisted into the new year, continuing with lines forming at Sydney’s ABC Bullion.

Geopolitical Influences

Heightened tensions in global politics are also influencing the gold market. The ongoing conflict between Ukraine and Russia has added layers of uncertainty, while potential trade disputes involving Canada have contributed to investor wariness.

Outlook for Other Precious Metals

Other precious metals have seen notable increases as well:

- Spot silver rose to approximately $108 per ounce, continuing a strong performance.

- Spot platinum increased by 2.9% to $2,845 per ounce.

- Spot palladium topped $2,050 per ounce with a 2% rise.

With continued momentum and investor interest, the outlook for gold and other precious metals remains optimistic as 2025 progresses. For updates on gold prices and market trends, stay tuned to Filmogaz.com.