Dow, S&P 500, Nasdaq Dip as Trump Trade Hopes Fade; Oracle, Intel, AMD, Tesla Move

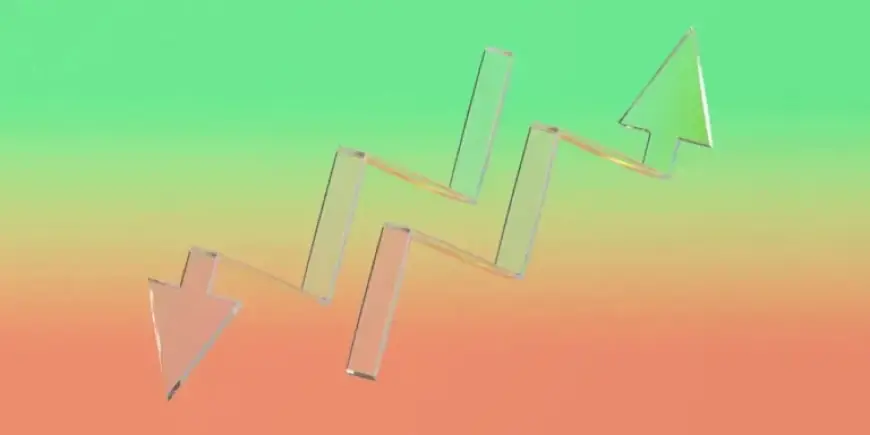

U.S. stock markets faced a decline as geopolitical tensions escalated, impacting investor sentiment. Friday’s trading session revealed mixed results among major indexes, with the S&P 500 dipping 0.1% and the Dow falling 0.3%. The Nasdaq remained flat.

Market Reactions to Geopolitical Tensions

This week’s stock performance was influenced by President Donald Trump’s fluctuating trade policies. Investors had initially welcomed his decision to avoid imposing tariffs on European allies regarding Greenland. However, renewed tensions with Iran shifted the market’s mood.

Investors reacted negatively to Intel’s latest outlook, predicting decreased growth due to surging memory component costs. Consequently, Intel’s shares plummeted by double digits.

Key Metrics

- S&P 500: Down 0.1%

- Dow: Down 0.3%

- Nasdaq: Flat

- S&P 500 Decline: 0.76% over the past two weeks

- Worst weekly dollar performance: Expected since June 27

Barclays strategists noted, “Earnings resilience & rates stability are key for equities to shrug off geopolitical noise.” These factors remain critical as investors navigate uncertain waters.

Currency and Commodities Update

The U.S. dollar decreased by 0.1% against a major currency basket. This week’s losses herald its worst performance in seven months. Meanwhile, the Japanese yen saw a rise, with signals suggesting potential intervention from the Japanese government to stabilize its value.

Gold prices are also on the rise, with projections of reaching $5,000 soon. Goldman Sachs forecasts prices may climb to $5,400 by year-end, as more investors turn to gold as a safe haven against global economic uncertainties.

Central bank purchases have historically contributed to the increase in gold prices, and current trends indicate a similar movement as global policy risks persist.