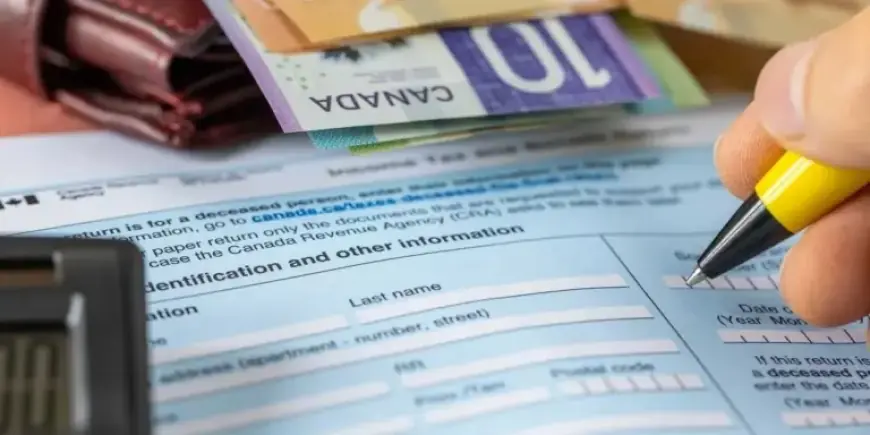

CRA Reveals Key 2025 Tax Return Changes Impacting Filers

As the tax season approaches, the Canada Revenue Agency (CRA) has announced significant changes for the 2025 tax year. These updates, which were released recently, include adjustments to tax brackets, new credits, and modifications to online account access. Here’s what you need to know to prepare for filing your taxes in 2026.

Key Dates for the 2025 Tax Season

The 2025 tax season begins on February 23, 2026, when the CRA opens its NETFILE service. Mark these essential dates in your calendar:

- March 2, 2026: Last day to contribute to an RRSP, PRPP, or SPP for 2025.

- March 2, 2026: Deadline for employers to issue T4 slips.

- April 30, 2026: Final day to file your tax return and settle any balance owed.

- June 15, 2026: Extended deadline for self-employed individuals and their partners, but taxes must be paid by April 30.

Tax Brackets and Basic Personal Amount (BPA) Adjustments

In 2025, federal tax brackets have been adjusted to account for a 2.7% inflation rate. Here’s the updated structure:

- 14.5% on the first $57,375 of taxable income

- 20.5% on income from $57,375 to $114,750

- 26% on income from $114,750 to $177,882

- 29% on income from $177,882 to $253,414

- 33% on income above $253,414

The Basic Personal Amount (BPA) has also increased:

- For incomes up to $177,882: BPA is $16,129

- For incomes over $253,414: BPA is $14,538

- Those in between will have a gradually adjusted BPA.

Changes to Tax Rates

A key update for 2025 is the reduction of the federal tax rate on the lowest income bracket from 15% to 14%. This change will create a blended rate of 14.5% for the entire year.

Additionally, Alberta has implemented an 8% tax rate for the first $60,000 of taxable income, down from 10%. Prince Edward Island has reduced all five personal tax rates for 2025 while slightly increasing the upper bracket.

New Top-Up Tax Credit

The CRA has introduced a new top-up tax credit for Canadians exceeding the first income bracket threshold of $57,375. This credit is designed to ensure that the value of non-refundable credits remains intact despite the lowered rates.

- Alberta has also introduced a similar non-refundable supplemental tax credit.

Enhancements to CRA Online Services

CRA has improved its online services for better user experience. Key changes include:

- Password resets can now be done online without a call to CRA.

- From July 15, 2025, representatives must use the CRA’s Represent a Client portal to submit authorization requests.

- Removal of the five-day processing delay for account access for representatives.

Expanded Deduction for Disability Supports

The list of eligible expenses for the disability supports deduction has widened for 2025. New eligible items include:

- Alternative input devices

- Attendant care services

- Digital pen devices

- Service animals

Updates on Capital Gains Rules

Two significant revisions will impact small business owners:

- Capital gains deductions are now available for specific cooperative conversions starting in 2024 and continuing into 2025.

- The capital gains rollover period for small business shares has been extended for qualifying sales made after December 31, 2024.

Elimination of Underused Housing Tax

Starting with the 2025 tax year, the Underused Housing Tax (UHT) will be eliminated. This means no UHT will be payable, simplifying the tax obligations for property owners. However, past UHT returns remain enforceable.

Conclusion

These updates from the CRA will significantly affect tax filing for 2025. It is essential for individuals and business owners to stay informed about these changes to maximize their tax benefits and ensure compliance.