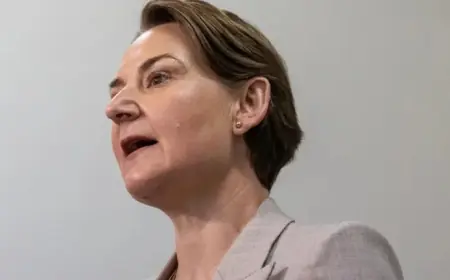

Caroline Ellison Leaves Federal Custody as the FTX Fallout Shifts From Courtroom Drama to Long-Term Consequences

Caroline Ellison, the former head of Alameda Research and one of the most consequential cooperating witnesses in the FTX criminal cases, has been released from federal custody around January 21, 2026, after serving roughly 14 months behind bars and spending part of the final stretch in community confinement. Her exit does not close the book on the FTX saga. Instead, it marks a new phase in which the consequences move from prison time and testimony to supervised obligations, financial penalties, and lasting restrictions on future leadership roles.

Ellison’s release also lands at a moment when the crypto industry’s regulatory and enforcement posture remains sharply defined by the FTX collapse: the personal legal arcs of former executives may wind down, but the structural impact on compliance expectations, governance standards, and market trust keeps expanding.

Why Caroline Ellison’s release matters now

Ellison’s custody period mattered for more than symbolism. As Alameda’s former chief executive and a central participant in the decisions that tied Alameda’s balance sheet to FTX customer funds, she became a key narrative bridge between the internal mechanics of the fraud and what jurors could understand in plain language. That cooperation helped anchor prosecutions of other figures in the case, including FTX founder Sam Bankman-Fried, who received a lengthy prison sentence and continues to pursue post-conviction challenges.

With Ellison now out of custody, attention shifts to three practical questions:

-

What restrictions remain on her professional life?

-

What financial penalties and monitoring obligations still apply?

-

How does her cooperation ripple outward into other civil and regulatory actions tied to FTX and the broader crypto market?

On the first question, the answer is unusually clear: regardless of where she works next, she faces a long, explicit barrier to holding certain corporate leadership roles.

What remains in force: the decade-long leadership ban

Even with her custodial sentence effectively complete, Ellison’s ability to return to executive power is sharply constrained. A federal market regulator secured final judgments and officer-and-director bars against several former FTX and affiliated executives, with Ellison consenting to a 10-year ban from serving as an officer or director of a public company.

That kind of bar is not a small footnote. It restricts the most visible leadership positions in regulated public markets and signals that, for enforcement officials, the FTX collapse is not merely a criminal story but a corporate-governance cautionary tale. It also shapes the incentives for future defendants in major financial cases: cooperation may reduce prison exposure, but it does not necessarily restore access to boardrooms.

A quick timeline of Caroline Ellison and the FTX collapse

Here is the condensed chronology that explains why her name continues to drive headlines:

-

November 2022: FTX collapses into bankruptcy after a crisis of confidence and liquidity.

-

December 2022: Ellison pleads guilty to multiple fraud and conspiracy charges and begins cooperating with prosecutors.

-

October 2023: She testifies against Sam Bankman-Fried, describing internal decision-making and the movement of funds between entities.

-

September 24, 2024: A federal judge sentences Ellison to two years in prison and orders approximately $11 billion in forfeiture.

-

Early November 2024: She reports to a federal facility to begin serving the sentence.

-

December 2025: Civil enforcement actions culminate in finalized penalties, including the 10-year officer-and-director bar.

-

January 21, 2026: Ellison leaves federal custody following time served and end-of-sentence placement in community confinement.

This timeline highlights the core tension of the case: Ellison occupied a central operational role, admitted wrongdoing, and provided substantial cooperation—yet the outcomes still carry a heavy mix of custody, financial liability, and durable career restrictions.

What comes next for Ellison and for the FTX legal universe

Ellison’s release does not mean freedom from consequences; it means a different category of consequences. Post-custody conditions typically include structured oversight and limits that can affect employment, travel, and financial reporting. Separately, the forfeiture order remains a formal judgment even if collecting the full amount is unrealistic in practice.

For the broader FTX universe, three developments remain the real drivers:

-

Appeals and post-trial litigation: Bankman-Fried’s legal strategy continues to shape public attention and can produce new hearings, filings, and rulings that keep the case alive for years.

-

Civil enforcement and follow-on cases: Regulators have shown they are willing to seek industry bans and conduct-based injunctions, not just fines, as a way to prevent a repeat of similar conduct.

-

The industry’s governance reset: The FTX collapse remains a reference point in boardroom conversations about conflicts of interest, custody practices, related-party transactions, and internal controls—especially when a trading firm and an exchange sit too close to each other.

Ellison’s departure from custody closes one chapter, but it doesn’t resolve the questions the scandal forced into the open: who controls customer assets, how leverage is disclosed, and what oversight actually exists when markets move fast and internal governance moves slowly.