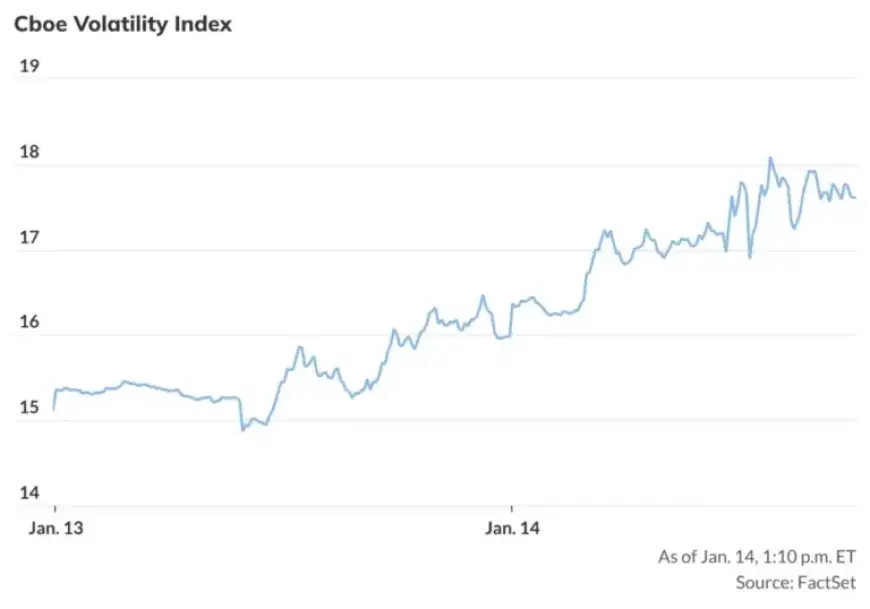

Volatility Surges 10% on Wednesday

On Wednesday, financial markets experienced notable declines. The downturn was attributed to escalating geopolitical tensions, particularly between the United States and Iran. Investors are also anxiously awaiting a crucial Supreme Court ruling regarding tariffs imposed by former President Trump.

Market Reactions to Geopolitical Tensions

In light of these developments, the Cboe Volatility Index (VIX) saw significant movement. The VIX rose by 1.58 points, reaching a total of 17.56, marking a noteworthy increase of 9.9% for the day.

Understanding the VIX

The VIX is often referred to as “Wall Street’s fear gauge.” It gauges anticipated near-term volatility by analyzing the premiums that traders are willing to pay for options contracts. A rising VIX indicates that traders are expecting greater fluctuations in the market.

- VIX closing value: 17.56

- Daily increase: 1.58 points

- Percentage gain: 9.9%

This surge in volatility suggests that many market participants foresee increased market turmoil in the near future. As these geopolitical tensions continue, they are likely to influence trading behaviors in the coming days.