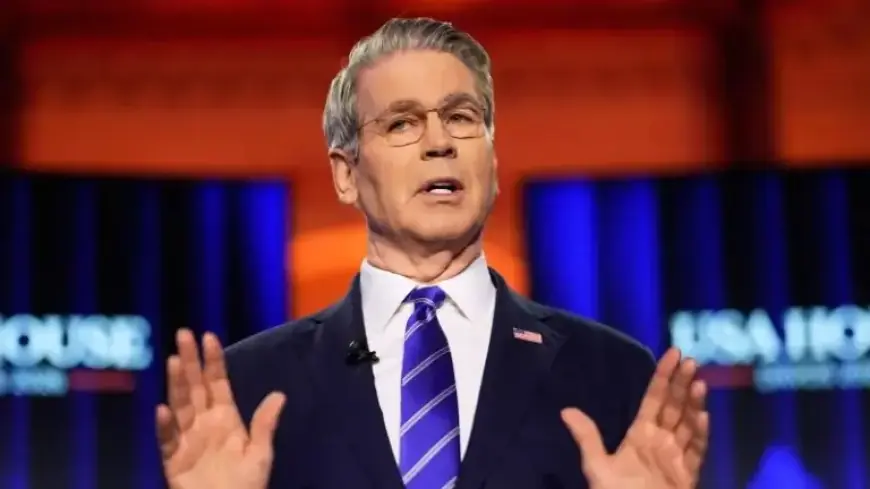

Treasury Secretary Bessent Dismisses Denmark’s US Investment as ‘Irrelevant’

Treasury Secretary Scott Bessent addressed Denmark’s recent decision regarding its investments in U.S. Treasury bonds during a press conference at the World Economic Forum in Davos, Switzerland. He labeled Denmark’s investment as “irrelevant” in the context of broader financial concerns.

Bessent Dismisses Denmark’s U.S. Investment as ‘Irrelevant’

Denmark’s pension fund, AkademikerPension, announced it would divest approximately $100 million from U.S. Treasury holdings due to concerns about American government finances. Bessent, however, emphasized that this amount represents a trivial portion of the total $30.8 trillion U.S. Treasury market.

Investment Overview

- Denmark’s total investment in U.S. Treasury bonds is nearly $10 billion.

- This figure has declined significantly from around $18 billion in 2021.

- AcademikerPension’s move comes after years of gradually reducing its Treasury holdings.

Bessent expressed indifference regarding potential withdrawals by European institutional investors, stating, “I’m not concerned at all.” He pointed out that Denmark’s divestment is part of a long-standing trend rather than an immediate crisis.

Context of U.S.-Denmark Relations

The comments from Bessent occurred alongside ongoing tensions related to President Donald Trump’s ambitions regarding Greenland. Trump has proposed substantial tariffs on allies opposing his interest in the territory, prompting criticism from various European nations.

As analysts have speculated about the potential for European nations to divest from U.S. Treasuries, Bessent dismissed these predictions. He attributed these notions to a single Deutsche Bank analyst and noted that the bank itself distanced from the report.

Market Perspective

Despite ongoing speculation about the withdrawal of other significant holders of U.S. debt, including Japan and China, demand for U.S. Treasuries has remained robust. This stability is crucial for financing the current U.S. government’s policies and tax initiatives.

While discussions at the World Economic Forum aim to alleviate geopolitical tensions, Bessent’s comments reflect confidence in the U.S. Treasury market’s resilience amidst fluctuating international relations.