ASX Drops as S&P 500 Declines; Gold Prices Surge

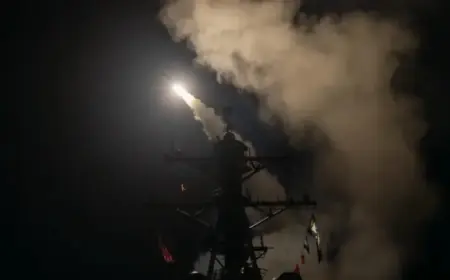

The Australian share market experienced a downward trend for the third consecutive day on Wednesday. This decline followed significant losses on Wall Street, reflecting growing concerns over recent geopolitical tensions and economic policy moves from the United States.

Market Overview

The S&P/ASX 200 index dropped by 0.3 percent, which is equivalent to a decline of 29.40 points, settling at 8786.50 as of 10:12 AM AEDT. Seven out of the eleven sectors within the index posted losses.

Influencing Factors

- The S&P 500 fell by 2.1 percent in the previous trading session.

- The US dollar experienced a decline while 30-year American bond yields rose close to 5 percent.

- Recent tariff proposals targeting several European nations have heightened market volatility.

Jimmy Tran, Moomoo Australia’s dealing manager, remarked on the inherent volatility of equities in the short term while noting their resilience over longer periods.

Sector Performances

Technology Sector

Technology shares faced significant pressure following a 5 percent drop in Netflix’s stock after its mixed quarterly numbers. Key technology stocks reported losses as follows:

- WiseTech Global: -2.1 percent

- Xero: -3.9 percent

- TechnologyOne: -2 percent

Banking Sector

Banking stocks also declined, highlighting a challenging environment:

- Commonwealth Bank: -1.6 percent

- National Australia Bank: -1.3 percent

- Westpac and ANZ: -1 percent each

Materials Sector

Contrarily, the materials sector saw gains, largely driven by rising gold prices:

- Gold price surpassed $US4700 for the first time, influenced by geopolitical factors.

- Newmont: +2.3 percent

- Northern Star: +2.6 percent

- Westgold: +9 percent, reporting record gold production of 111,418 ounces.

Noteworthy Stocks

Several companies attracted particular attention:

- Ampol fell by 1.6 percent after the Australian Consumer and Competition Commission referred its acquisition of EG Australia for further review.

- Lynas Rare Earths surged by 4 percent, benefiting from a rise in average selling prices for rare earths.

- Vulcan Energy increased by 1.9 percent, reporting positive results from a production flow test in Germany.

- Telix Pharmaceuticals saw a decline of 3.7 percent as its quarterly sales met expectations.

- Beach Energy gained 3.2 percent despite a quarterly production drop of 9 percent.

The performance of the Australian share market remains closely tied to international developments and economic signals, with investors keenly observing evolving circumstances.