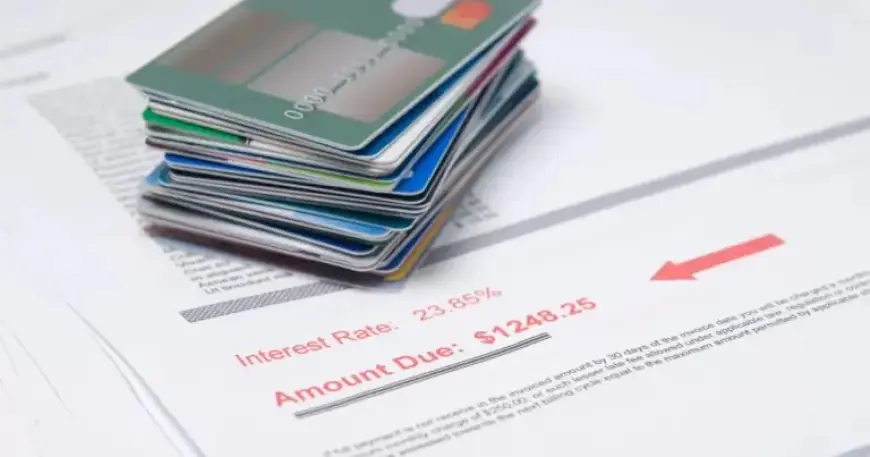

Trump’s Credit Card Cap Deadline Arrives: Will Companies Obey the 10% Limit?

On January 20, a deadline set by former President Trump for credit card companies to reduce interest rates to 10% arrived. Despite this date looming, most banks and card issuers have maintained their existing rates, expressing concerns regarding the lack of necessary details for compliance.

Background of the Credit Card Cap Proposal

Trump initially announced the interest rate cap on January 9, providing financial institutions with merely 11 days to adapt. In his post on Truth Social, he criticized the high-interest rates, which can reach up to 30%, claiming they flourished during the Biden administration.

The proposal received bipartisan backing from lawmakers such as Senator Elizabeth Warren (D-MA) and Senator Josh Hawley (R-MO). If implemented, it could potentially save consumers an estimated $100 billion annually in interest payments.

Industry Response and Concerns

Despite the potential benefits for consumers, the banking industry warns of negative repercussions. Many issuers may limit credit access for millions, particularly targeting vulnerable borrowers. According to a recent analysis from America’s Credit Unions, two-thirds of credit card users with balances may see their credit lines reduced or eliminated entirely.

- 47 million Americans with subprime credit scores could lose access to credit.

- Experts suggest a rate cap may require Congressional approval.

Bank lobbyists are uncertain about adhering to this proposed cap. There is currently no law mandating lenders to enforce a 10% interest rate. The Consumer Financial Protection Bureau confirms there is no federal law limiting credit card interest rates.

Expert Opinions on the Proposed Cap

Experts have pointed out that President Trump’s initiative may necessitate bipartisan support. For instance, a similar proposal was introduced by Senator Bernie Sanders in 2025. A study from Vanderbilt University indicated that a 10% limit could save consumers $100 billion, but it would demand legislative action for enforcement.

JPMorgan Chase’s Chief Financial Officer Jeremy Barnum expressed concerns during a recent investor call. He stated that the cap could reduce credit access for those who need it most, potentially producing a negative impact on the economy.

New Developments in Response to the Proposal

Amidst this discussion, fintech company Bilt has announced a new credit card that aligns with Trump’s proposal. This card will cap interest rates at 10% for one year, showcasing a direct response to the lack of compliance from major banks.

As consumers and banks navigate these changes, the future of credit card interest rates remains uncertain. The industry is still awaiting a clear directive from the White House on enforcement mechanisms and compliance expectations.