US Bank Stocks Plunge as Credit Card Rate Cap Deadline Looms

U.S. bank stocks faced significant declines as the January 20 deadline approached for a potential new cap on credit card interest rates. Investors are concerned about how this proposed 10% cap would impact the banking sector and consumers alike.

Key Details Surrounding the Credit Card Rate Cap

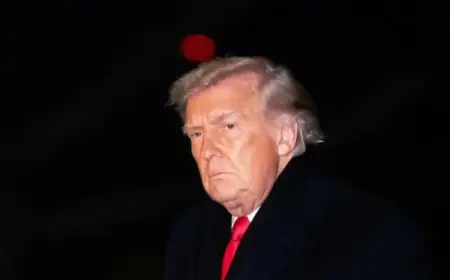

The Trump administration announced the cap with the intention of improving affordability for consumers. However, banks warn that it could restrict credit availability. They argue that such a cap would hinder their ability to manage risks associated with unsecured credit cards.

Market Reactions

- JPMorgan Chase shares fell by 1.8%.

- Citigroup experienced a drop of 2.4%.

- Wells Fargo was down 0.6%.

- Morgan Stanley and Goldman Sachs also faced declines of 2.2% and 1.5%, respectively.

- The S&P 500 Banks index decreased by 1.2%.

Industry experts, including JPMorgan CEO Jamie Dimon, warned that the proposed cap could negatively impact consumers. Dimon pointed out that the firm could consider legal actions in response to these changes.

Impact on Consumers and Banks

The American Bankers Association projected that 137 million to 159 million credit cardholders could lose access to their accounts if the rate cap is enforced. U.S. Bancorp CEO Gunjan Kedia highlighted that over 90% of their clients would suffer adversely from such a measure.

Potential Alternatives and Compromises

Analysts suggest that credit providers might adapt their offerings through innovative strategies. These could include:

- Lower rates for select customers.

- No-frills credit cards at the capped rate, albeit with no rewards.

- Reduced credit limits.

Furthermore, TD Cowen analysts hinted at the possibility of a political compromise. This compromise could prevent the necessity of a rigid 10% cap through voluntary banking solutions, such as the suggested “Trump cards.”

As discussions evolve, the focus remains on balancing the interests of banks and consumers while ensuring regulations adapt to the changing financial landscape.