Netflix Transforms Warner Bros. Offer into All-Cash Deal

Netflix is restructuring its significant $83 billion deal for Warner Bros. The streaming service has opted for an all-cash offer, eliminating the $4.50 per share in Netflix stock included in the initial bid. This change puts pressure on David Ellison’s Paramount, which is advocating for its own $30 per share cash offer to be considered superior.

Key Details of Netflix’s All-Cash Deal for Warner Bros.

Netflix’s amended proposal now provides $27.75 in cash for Warner Bros. This adjustment leaves Discovery Global as an independent entity. The ongoing competition revolves around the valuation of this standalone company. The primary question is whether Netflix’s offer, which includes a split of Discovery, or Paramount’s comprehensive bid, is more appealing.

Valuation Insights from Warner Bros. Discovery

In a recent proxy filing, WBD articulated potential valuations for Discovery Global. The estimates range from:

- Low of $1.33 per share

- High of $6.86 per share

The firm performed a public companies analysis and a sum-of-parts analysis, yielding varied equity value references. Paramount, in its filings, suggested that Discovery’s value might be minimally assessed at $0 to $0.50 per share by comparing its performance to that of Versant.

Negotiations and Legal Actions

Paramount’s legal efforts have included a court case seeking deeper insights into WBD’s valuation methods. Additionally, Ellison has indicated possible proxy battles to challenge Netflix’s deal during an upcoming special shareholder meeting. The date for this pivotal meeting has yet to be announced.

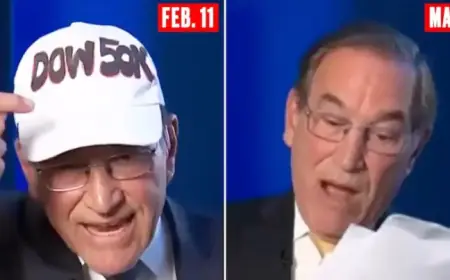

Statements from Company Executives

David Zaslav, President and CEO of Warner Bros. Discovery, expressed enthusiasm about the merger. He stated that merging with Netflix would enhance storytelling and benefit audiences globally. Similarly, Netflix’s co-CEO, Ted Sarandos, voiced confidence in the revised all-cash deal, asserting it would expedite the decision-making process for shareholders.

Greg Peters, Netflix’s other co-CEO, emphasized that this agreement signifies a commitment to further growth in global entertainment. The dual aim is to create significant value for stakeholders while fostering innovation and job creation in the industry.

Conclusion

Netflix’s move to transform its Warner Bros. offer into an all-cash deal signifies a strategic pivot that could reshape the entertainment landscape. As negotiations evolve and shareholders begin weighing their options, the future of both Netflix and Warner Bros. Discovery hangs in the balance.