Netflix Transforms Warner Bros. $83 Billion Acquisition into All-Cash Deal

Netflix has finalized an all-cash acquisition agreement for Warner Bros. Discovery’s studios and HBO Max operations. This strategic move is aimed at countering Paramount Skydance’s competing takeover bid.

Overview of the Deal

On Tuesday, Netflix and Warner Bros. Discovery (WBD) announced an updated agreement wherein Netflix will purchase WBD’s assets at a price of $27.75 per share. The deal maintains an enterprise value of about $82.7 billion.

Key Features of the Acquisition

- All-cash transaction streamlined for greater clarity.

- Accelerates the timeline for WBD stockholder approval.

- All previous stock valuation concerns due to Netflix share fluctuations have been eliminated.

The changes come as part of Netflix’s response to Paramount Skydance’s all-cash offer, which has created pressure on WBD to consider alternative options. Paramount’s earlier attempts to acquire WBD faced rejection, yet it continues to advocate for its bid, stating it can withstand regulatory scrutiny more effectively than a Netflix-WBD combination.

Timeline and Financial Details

The revised agreement allows for a WBD stockholder vote by April 2026. WBD has filed a preliminary proxy statement with the SEC to expedite this process. Netflix has also adjusted the proposed net debt assumed by Discovery Global—down by $260 million—due to better-than-expected cash flow projections for 2025.

| Date | Action | Details |

|---|---|---|

| December 5, 2025 | Original Agreement Signed | Initial acquisition terms announced. |

| April 2026 | Stockholder Vote | Projected date for WBD’s vote on the acquisition. |

| 12-18 Months Post Agreement | Expected Deal Closure | Pending regulatory approvals. |

Impact and Reactions

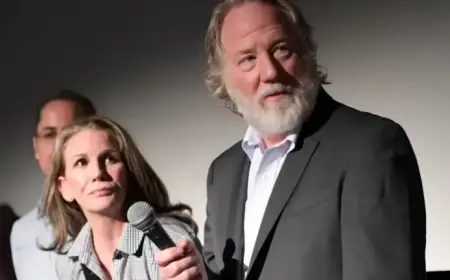

Executives from both companies expressed optimism about the deal. David Zaslav, WBD’s president and CEO, emphasized the merger’s potential to enhance storytelling capabilities. Netflix co-CEO Ted Sarandos highlighted the financial certainty that this all-cash agreement provides, stating it enhances value for stockholders and audiences alike.

The deal paves the way for Netflix to gain access to Warner Bros. film and television studios, HBO, HBO Max, and a games division. This acquisition is expected to boost Netflix’s content offerings and original programming capabilities, consequently driving job creation within the entertainment sector.

Regulatory Landscape

The transaction faces regulatory scrutiny in the U.S. and Europe. Both Netflix and WBD have filed necessary notifications with the FTC and the Justice Department’s antitrust division. They are actively engaging with competition authorities to facilitate smooth approval processes.

Conclusion

Netflix’s all-cash acquisition deal appears to be a decisive step in reshaping the streaming landscape. With substantial investments and strategic planning, Netflix aims to solidify its position as a leading provider of film and television content.