Download Arrow Button Icon: Enhance Your Interface Design

In California, a significant debate is unfolding around a proposed wealth tax aimed at billionaires. This comes as some affluent residents distance themselves from the policy while others advocate for its implementation.

2026 Billionaire Tax Act Overview

The proposed 2026 Billionaire Tax Act plans a one-time 5% wealth levy on Californians with net worths exceeding $1 billion. Currently, these billionaires pay no recurring wealth tax beyond standard income and capital gains taxes.

Projected Revenue and Allocation

- The tax is expected to generate around $100 billion.

- Approximately 90% of this revenue will fund healthcare programs.

- The remaining funds will support education, food assistance, and administrative expenses related to tax collection.

Advocates for the Wealth Tax

Dave Nixon, a former healthcare executive and member of the Patriotic Millionaires organization, has voiced his support for the tax. After relocating to Pasadena from Florida in 2022, Nixon highlighted the importance of investing in healthcare and education.

Nixon criticizes the notion that raising taxes will drive billionaires out of California. He argues that this claim is often used by wealthy individuals to oppose higher taxes. “California’s higher taxes on wealthy people like me are exactly what makes it the kind of state I want to live in,” he stated.

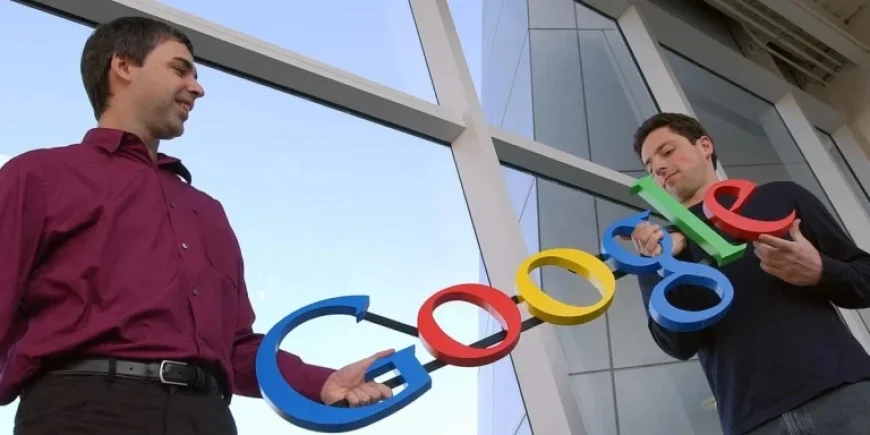

Responses from California’s Billionaires

California boasts over 200 billionaires, many of whom have expressed differing opinions on the wealth tax proposal. Some high-profile figures, like venture capitalist Peter Thiel and Google founders Larry Page and Sergey Brin, are reportedly considering relocating to Florida. Conversely, Nvidia CEO Jensen Huang has publicly stated that leaving California has never crossed his mind.

Nixon expressed disappointment in billionaires contemplating leaving the state, emphasizing their success in an environment fostered by California’s supportive policies.

Healthcare Costs and Economic Implications

Maureen Kennedy, also a member of the Patriotic Millionaires, supports the rationale behind the wealth tax. After living in California since 1996, she noted that high healthcare costs have been outpacing wage increases.

- Healthcare spending rose by 7.5% from 2022 to 2023.

- In contrast, average wages increased by only 4.43% during the same timeframe.

The tax could help offset these rising costs, particularly as about 3.4 million Californians are anticipated to lose MediCal coverage due to recent Medicaid funding cuts. Kennedy highlighted the disparity in tax burdens between average residents and billionaires.

Tax Rates Comparison

| Group | Average Tax Rate (2018-2020) |

|---|---|

| Billionaires | 24% |

| Overall Population | 30% |

| Top Income Earners | 45% |

This proposed tax reflects broader themes of equity and the responsibilities of wealth in supporting public goods. Advocates maintain that such measures are necessary to ensure a balanced societal contribution from all citizens, especially those who can afford it the most.