New York Fed: American Consumers and Companies Bear 90% of Trump’s Tariffs

A recent report from the Federal Reserve Bank of New York reveals that American consumers and companies are bearing the brunt of tariffs implemented during President Donald Trump’s administration. According to the report, which relies on data from the U.S. Census Bureau, nearly 90% of the tariffs imposed were effectively paid by U.S. households and businesses in 2025.

Key Findings of the New York Fed Report

The report indicates significant tariff contributions from American consumers:

- Overall Burden: Nearly 90% of tariffs paid by Americans in 2025.

- Monthly Breakdown:

- 94% from January to August 2025

- 92% from September to October 2025

- 86% in November 2025

- Average Tariff Rate: Increased from 2.6% to 13% over the course of 2025.

The economists involved in the study, including Mary Amiti and David E. Weinstein, emphasized that U.S. firms and consumers continue to absorb most of the economic burden of high tariffs. The data suggests that while foreign exporters reduced their prices slightly, U.S. companies were left to either absorb the elevated costs or pass them on to consumers.

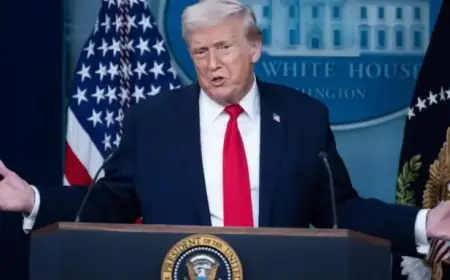

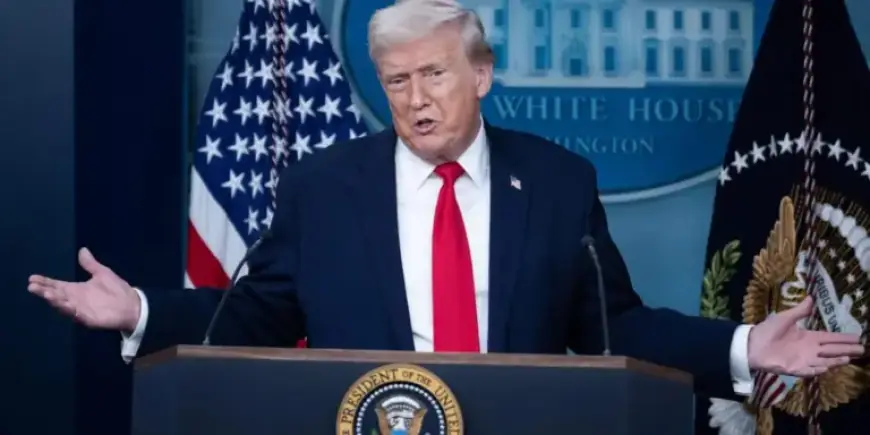

Contradicting Trump’s Claims

President Trump has consistently maintained that foreign businesses are responsible for covering the cost of these tariffs. However, this recent report counters that narrative. In an op-ed for the Wall Street Journal, Trump stated that the incidence of tariffs fell largely on foreign producers and middlemen.

Despite his claims, the House of Representatives has responded to economic pressures by passing a resolution aimed at reversing certain tariffs imposed on Canada. Furthermore, the legality of these tariffs is under review by the Supreme Court, which may yield significant implications for trade policy moving forward.

Impact on Consumer Confidence

As a result of these tariffs, consumer confidence has plummeted to its lowest level in over a decade. Economic anxiety among consumers is attributed to rising prices, especially concerning essential goods. Dana Peterson, Chief Economist at the Conference Board, noted an increase in mentions of tariffs, trade, and rising costs in consumer surveys completed in January.

Corporate Responses to Tariffs

American businesses are proactively responding to the tariffs. Procter & Gamble announced price increases on essential items, while General Motors projected significant profit losses due to the tariffs. Analysts warn that the increase in tariffs will likely escalate car prices among other products.

Economic Implications

Evidently, the economic costs surrounding these tariffs surpass any potential benefits projected by Trump’s administration. A study from the nonpartisan Tax Foundation revealed that U.S. households face greater tariff costs than the benefits gained from tax cuts. While tax cuts could increase returns by approximately $1,000, the total tariff burden is expected to exceed $1,300 in 2026.

This analysis highlights the complex relationship between trade policies and their effects on the American economy. As tariffs evolve, the repercussions for consumers and businesses remain a critical point of discussion in U.S. economic policy.