Tech Selloff Overshadows Inflation Relief, Driving Wall St Toward Weekly Losses

U.S. stocks are facing significant challenges as a tech selloff overshadowed relief from softer-than-expected inflation data. This trend is leading Wall Street toward potential weekly losses, marking the worst performance since November.

Market Overview: Stock Index Performance

On February 13, the major U.S. stock indexes experienced declines:

- Dow Jones Industrial Average fell by 67.89 points, or 0.14%, closing at 49,384.09.

- S&P 500 dropped by 3.79 points, or 0.06%, to 6,828.97.

- Nasdaq Composite decreased by 51.78 points, or 0.23%, finishing at 22,545.37.

Inflation Data and Monetary Policy Outlook

Recent reports indicated that U.S. consumer prices increased less than anticipated in January. This outcome raised expectations for a potential Federal Reserve interest rate cut in June, from 63% to 69%.

Michael Metcalfe, head of market strategy at State Street Markets, emphasized that the disinflation trend is continuing. This trend suggests a more favorable inflation outlook, paving the way for lower interest rates later in the year.

Technology Sector Challenges

Technology stocks have notably struggled, reflecting concerns about potential disruptions from artificial intelligence. Major companies such as Nvidia and Apple saw declines of 2% and 0.8%, respectively, impacting both the S&P 500 and Nasdaq.

Market participants are increasingly wary of high valuations, especially amidst heightened competition. Brent Schutte, Chief Investment Officer at Northwestern Mutual Wealth Management, noted that investors are cautious about future earnings which need to materialize for sustained market growth.

Earnings Season Insights

With earnings season well underway, the “Magnificent Seven” tech companies are anticipated to invest around $650 billion in capital expenditures focused on AI. Investors are keen for tangible returns from these investments.

Positive news came from Applied Materials, which saw its shares rise by 10% after the company provided an optimistic revenue forecast. Additionally, Arista Networks reported an annual revenue outlook that exceeded expectations, contributing to its 5.3% increase.

Sector Performances and Tariff Updates

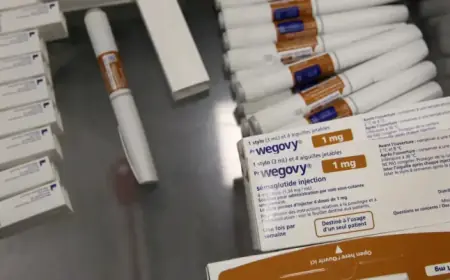

Healthcare stocks exhibited strength on this day. Eli Lilly increased by 2.2% and UnitedHealth rose by 0.7%. Conversely, the steel and aluminum sectors reacted negatively to news of an impending rollback of tariffs by U.S. President Donald Trump. Following this announcement:

- Nucor down by 2.9%

- Cleveland-Cliffs fell by 3.6%

- Steel Dynamics decreased by 3.7%

- Alcoa saw a decline of 2%

- Century Aluminum dropped by 6.4%

Despite the market’s overall decline, advancing stocks outnumbered declining ones on both the NYSE and Nasdaq, reflecting some resilience in certain sectors.

Conclusion

The combination of a tech selloff and evolving inflation data presents a complex landscape for Wall Street. Investors continue to navigate through uncertainties while seeking opportunities amidst the persistent economic fluctuations.