Republicans Disrupt D.C. Tax Season, City Leaders May Retaliate

In a significant move affecting tax policies, congressional Republicans have disrupted the tax season for D.C. residents by repealing a tax bill approved by the D.C. Council. This resolution passed the Senate on Thursday, following a similar vote in the House the previous week. City officials are concerned that this decision could create turmoil for local taxpayers.

Congressional Action on D.C. Tax Policy

This marks a rare occasion in D.C.’s history, being only the fifth instance in 50 years that Congress has repealed a local law. Notably, it is the first time Congress has targeted local legislation concerning tax policy directly. The D.C. Council had previously enacted a law that separated the city’s tax code from specific changes made by former President Donald Trump’s federal tax overhaul, known as the One Big Beautiful Bill. This decision was projected to prevent an estimated $600 million loss in revenue over four years.

Effects of the Repeal

- Local taxpayers could face extended waits for tax refunds.

- Tax preparers may experience delays in processing returns.

- City officials warn of significant administrative challenges.

The D.C. Council’s law was designed to prevent certain tax cuts, particularly those exempting tips and overtime from taxation, from being applied locally. Instead, it sought to utilize expected revenue to enhance the Earned-Income Tax Credit and establish a new Child Tax Credit for families in need. Advocates argue these measures would support low- and moderate-income households within the city.

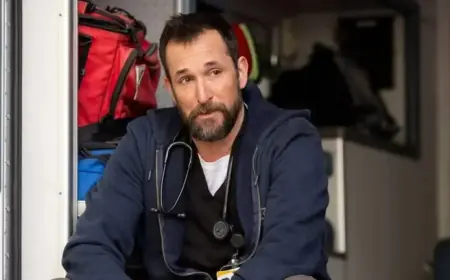

Political Responses and Concerns

During debates, Senator Ron Wyden expressed frustration regarding Congress’s intervention. He questioned the authority of Congress to overrule the decisions made by elected D.C. representatives. Meanwhile, Senator Rick Scott contended that congressional involvement was necessary to ensure residents received the full benefits of Trump’s tax cuts.

Uncertainty regarding the repeal continued, particularly over whether Congress acted within the designated 30-day review period. D.C. Council Chairman Phil Mendelson raised concerns about the timing of the repeal, asserting that it might not have complied with procedural deadlines.

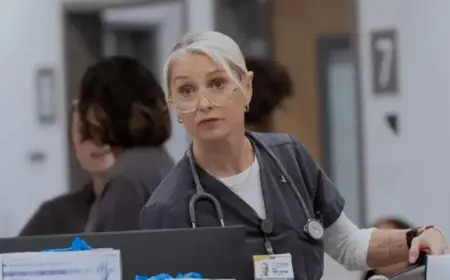

Tax Filing Season Challenges

D.C.’s Chief Financial Officer, Glen Lee, is now tasked with navigating the implications of this repeal during the ongoing tax-filing season. The changes may lead to a halt in processing for many residents and businesses while new forms and guidance are developed for tax preparation services.

- As of Wednesday, over 42,000 local tax returns had already been submitted.

- Concerns from residents include potential delays in receiving expected refunds.

Mayor Muriel Bowser emphasized the difficulties facing tax filers, describing the situation as chaotic. A coalition of local business organizations also expressed their worries, emphasizing that reversing the decoupling would generate confusion during an already critical time for tax filing.

For now, the Office of Tax and Revenue in D.C. has stated that the tax-filing season is open, processing returns according to current local laws despite the congressional actions.